India is a growing and developing country, but high inflation becomes a bump in the development of the economy.

On 12th March 2022, National Statistics Office released the official number for Monthly Inflation and industrial productivity.

Inflation

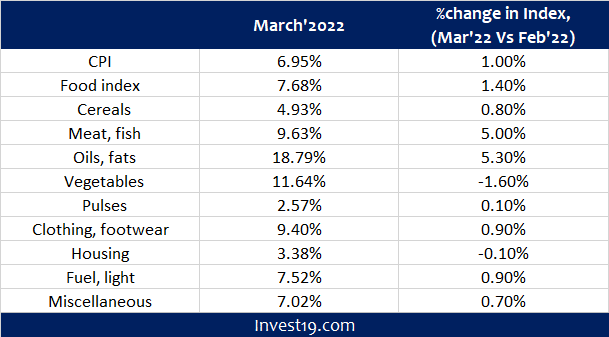

The consumer price index rose to a seventeen-month high of 6.95% in March 2022 much higher than the 6.07% recorded in the previous month. The inflation number also superseded the market estimate of 6.35% and also RB’s estimate of 6.3% average inflation for Jan-March,2022.

Reason for higher inflation

- A large portion of the increase is amid a rise in the prices of animal protein.

- The second is edible oil which surged by 5.3% on an MoM basis.

- The fuel and light group posted annual inflation of 7.52%.

With a continuous rise in inflation, the market can expect a rate hike by the apex bank of the country RBI. It could be a gradual rise in interest rate by 50-75 basis points by the end of Q2 of FY2023 and then we can further expect a second hike if inflation doesn’t come under control.

Index of Industrial Production (IIP)

It measures the factory output during a particular period. The IIP data is released 45 days after the month ends. To the data released by the National Statistics Office (NSO), on 12th March, the IIP for Feb grew by a mere 1.7% on year on year basis to 132.1.

IIP in the FY2021-22( April 2021- Feb 2022) has surged by 12.5% compared to a contraction of 11.1% for the corresponding period a year ago.

The growth in IIP is attributed to:-

- The mining and Electricity sectors rose by 4.5% each for the same month to 123.2 and 160.8, respectively.

- The key manufacturing sector grew by 0.8% to 130.8.

The matter of concern is the reduction in the production of capital goods which grew by 1.1% on a YoY basis against 1.4% growth recorded in January 2022. Further capacity utilization is also below the benchmark of 75% and currently stands at 72.4%.

Investors and the market will have to wait to see RBI’s stance on the situation of higher inflation and slower industrial production a double whammy situation, in their next meeting to be held in June.