After long years, India must be prepared for massive disinvestment by the Government of India. In Fy2022, the government has set a disinvestment target of Rs 1.75 lakh crore, with strategic sale of IDBI Bank, BPCL, Shipping Corporation, Container Corporation, Neelachal Ispat, Pawan Hans among others.

But the hustle and buzz in the new year is around the biggest life insurer of the country and gem company of the government of India, i.e Life insurance corporation of India (LIC). It will be one of the biggest IPOs to hit, in the history of the Indian stock market. Lots of numbers and valuation of LIC and decisions on the same have delayed the LIC initial public offering, but it is worth the wait.

The LIC IPO is expected to hit the market by March 2022, with the valuation process of the insurance behemoth now completed. In the disinvestment process, the Government of India is looking to divest 5-10% equity in the life insurance corporation of India (LIC).LIC has been made market-ready for IPO post 27 legislative changes to the Life Insurance Corporation Act, 1956 through the Finance Act, 2021.

GoI was expected to mop over 1 lakh crores, but the point to be kept in consideration is the actuarial valuation of the embedded value (EV) — a key metric in the valuation of insurers. However, LIC, as of now has been exempted from disclosing its embedded value (EV). Draft Red herring prospectus is indicated to have the details of computation of embedded Value(EV) done by the world’s largest provider of actuarial services, Milliman.

On the pricing of the IPO, it will be decided by the government through a Cabinet committee, post-approval of SEBI. To smoothen the IPO process for large entities like LIC, the securities exchange board of India has made some regulatory changes, like It has relaxed the minimum offer rule to 5% of the post-issue equity if the post listing market value of the company is over Rs1-lakh crore. Further, it also has relaxed the minimum public shareholding norm to 10% within two years and 25% in five years.

As the biggest insurer in the country comes closer to its maiden public offering, Lic has asked its policyholders to update their Pan cards, so they could take part in the IPO. If the sources are to be believed,10% of the LIC IPO will be reserved for its policyholders.

LIC policyholders must make their PAN updated with their policies, so the corporation has the records of the holder’s PAN. Policyholders must hold a Demat account, in addition to their PAN updating to participate in one of the biggest IPOs the Indian market will witness.

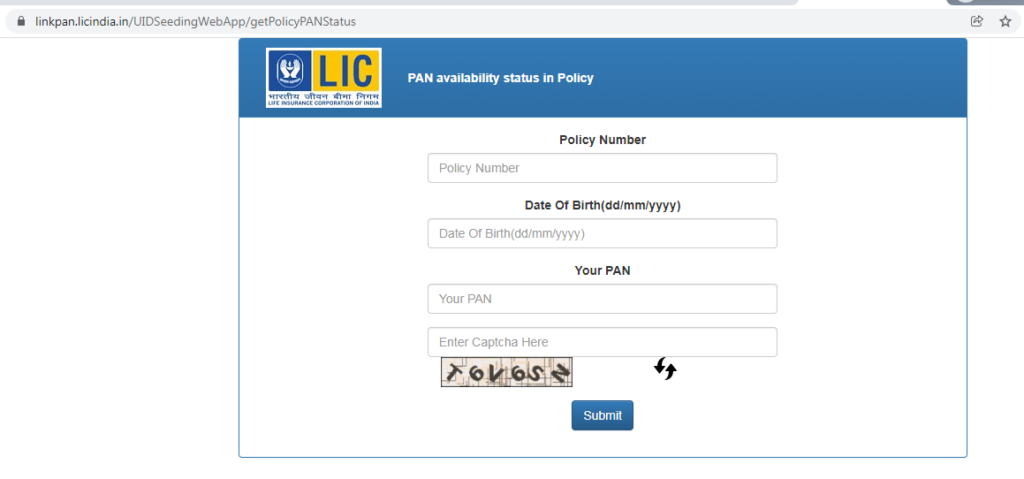

For updating and checking the Permanent Account Number (PAN) with LIC step to be followed:-

- Go to https://linkpan.licindia.in/UIDSeedingWebApp/getPolicyPANStatus

- Enter your Policy Number, Date Of Birth(dd/mm/yyyy), PAN

- Captcha in the designated boxes.

- Press Submit.

In case the policyholders, do not have a DEMAT account. The holders will have to open a DEMAT account at their cost. To open a free DEMAT account, policyholders can visit Invest19.com and get their DEMAT account within minutes. The process of opening the DEMAT account is completely electronic, upload the required document and one can have his/her DEMAT account activated with a few working hours.

To participate in the LIC IPO investors must have a DEMAT account and the policyholders must update PAN and have a DEMAT account. With everything in place, investors will be able to take part in the maiden public offering of LIC. However, all the investors must do their research, before investing in the market, as the market is subject to uncertain risk.

Requirements to open a DEMAT account:

- A bank account

- Permanent Account Number (PAN)

- Adhaar Card

Reasons to Open a DEMAT account with Invest19

Invest19 is a fintech company that has developed an application that has brought several brokers under one platform. Investors can come and open a free Demat account through this application with any of the renowned brokers available on the application, without having the hassle to visit the broker. The entire process starting from opening the Demat account till you start investing is all electronically processed and 100% paperless.

Steps to open DEMAT account through Invest19 app:

- Download Invest19 app from Google Play Store (https://play.google.com/store/apps/details?id=com.invest19.app&hl=en_US&gl=US)

- Register on the application, with a valid email ID or Phone number.

- Select from the available list of brokers on the application.

- Fill the form online with details like name, address, phone number, email ID, details of your government ID, bank details, etc.

- Upload documents required. ( PAN, Adhaar, Photo)

- Click on submit

- Investors will receive an email for successful registration and a subsequent email for DEMAT activation.

Opening a DEMAT account on the INVEST19 application is free of cost, no matter whoever broker you choose. The process is entirely online and it takes a few minutes to complete the process. Download the INVEST19 app to participate in the share sale of LIC, the largest IPO to hit the Indian market in the year 2022.