Acquired by Baba Ramdev’s Firm Patanjali in the year 2019, Ruchi soya s all set to raise Rs4,300 crores through a follow-up public offering. Ruchi Soya is a diversified FMCG and FMHG focused company, with strategically located manufacturing facilities and well-recognized brands having a pan India presence. The firm is one of the largest FMCG companies in the Indian edible oil sector and fully integrated edible oil refining companies in India.

The company operates across the entire value chain in the palm and soya segment, with a healthy mix of upstream and downstream businesses. The firm has been allocated zones to undertake palm plantation by the Government, which assists them in backward integration of sourcing palm oil. Ruchi Soya is the largest player in terms of allocated zones. Their integration also extends downstream to the oleochemicals and other by-product and derivatives businesses.

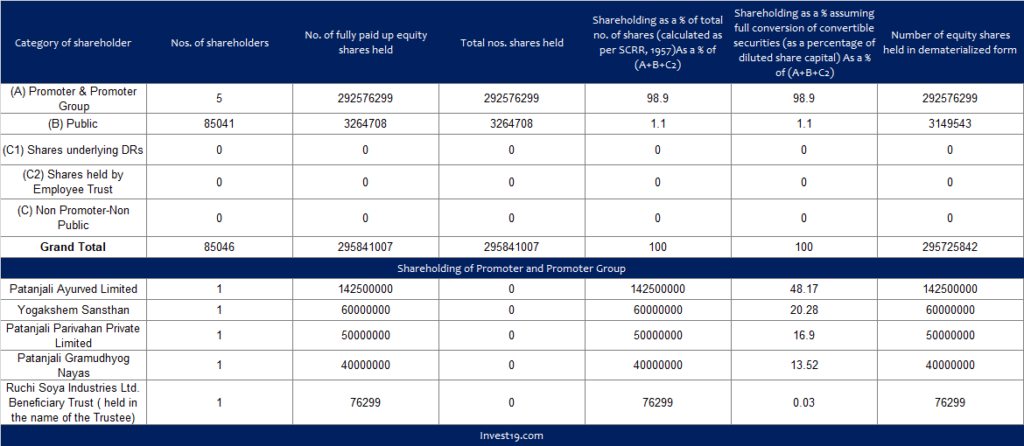

Current Share Holding Pattern of Ruchi Soya

Alone Patanjali owns over 98.9% of shares am post this FPO Patanjali’s shareholding will come down to 80.82%. Over the next three years, as per the norms of SEBI, Patanjali will have to reduce its shareholding to 75%. Thus, Ruchi soya will again come with another FPO in the coming years.

Currently, Ruchi soya is trading at Rs910 on NSE and the FPO has a price band of Rs615-Rs650, thus the FPO will give investors a better chance for gains on listing.

Details of Ruchi Soya FPO

- IPO Size: -4300crore

- Price Band: –615-650

- Issue Open Date: –24th March 2022

- Issue Close Date: –28th March 2022

- Listing Date: –6th April 2022

- Minimum Lot Size: –21 shares

- Book running lead managers:- Axis Capital, ICICI Securities Limited, SBI Capital Market Limited

- Registrar of the issue:- Link Intime India Private Limited

Funds to be utilized from the FPO in the following manner:-

- Repayment and/or prepayment of the company’s borrowings either partially or fully.

- Funding working capital requirements.

- General Corporate purposes.

Financial performance:-

- Ruchi Soya reported operating revenue of Rs 1,63,830 lakh in FY21 up by 24.34% from Rs1,31,753.7 lakh reported for the same period a year ago.

- EBITDA rose by almost 122% to Rs10,183.7lakh in FY21 from Rs 4,584.72 lakh reported in FY20.

- Basic EPS dropped to 23.02 in FY21 from 871.28 reported in FY20.

Ruchi Soya is the pioneer and largest manufacturer of soya foods has aided their brand ‘Nutrela’ in becoming a household and generic name in India. Further, it also has respectable financial numbers. Thus Ruchi soya is certainly a valuable investment that can fit in investors’ financial portfolios. However, investors must know that every investment in the market is subject to market risk and thus thorough homework must be done before investing.

Click here for detailed information on Ruchi soya