2021 has been the year of IPO, with the number of new-age start-ups filling for IPO and ultimately launching it. To name a few, Zomato, Nykaa, Paytm among many all. Nykaa did bumper opening. But PAYTM the most awaited IPO of the year 2021 worth Rs18000 crores was a disaster, as it was listed at discount. On the listing day itself, it hit the low of Rs1271, and today it is trading at around 775.05. The Paytm shares have lost more than half of their value.

Securities Exchange Board of India, the market watchdog has tightened the valuation for the firms in line for IPO. The major key points touched are the key internal business metrics used to arrive at valuations. This has certainly shaken the bankers, and companies who are lining up for the IPO are worried about delays in launches.

The major reason behind this tightening is that most of the new tech companies remain in losses for a longer time frame and traditional financial disclosure is not of great help to the investors. Thus, before even deciding tightening policies for the IPO valuation, SEBI has asked all the firms due for their IPO to get non-financial metrics like Key performance indicators audited and how are these being used to arrive at a valuation for the firm. Non-financial metrics are difficult to audit or connect to a company’s performance and thus valuation.

This tightening by SEBI has certainly shaken the companies and bankers. Further, the companies will also have to justify the valuation, as per the information floating in the market.

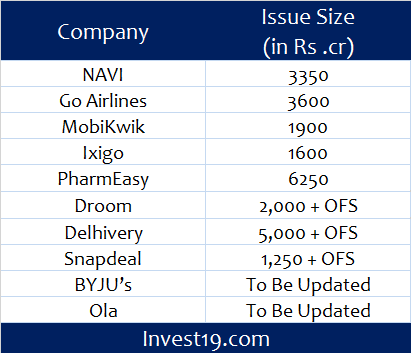

Upcoming IPOS that will be effected by this move are as follows: