Ruchi Soya is a diversified FMCG and FMHG focused company, with strategically located manufacturing facilities and well-recognized brands having a pan India presence. The firm is one of the largest FMCG companies in the Indian edible oil sector and a fully integrated edible oil refining company in India. Being the pioneers and largest manufacturers of soya foods has aided their brand ‘Nutrela’ in becoming a household and generic name in India.

Ruchi Soya Listing and Allotment Status

- Allotment Date-31st March 2022

- Listing Date-6th April 2022

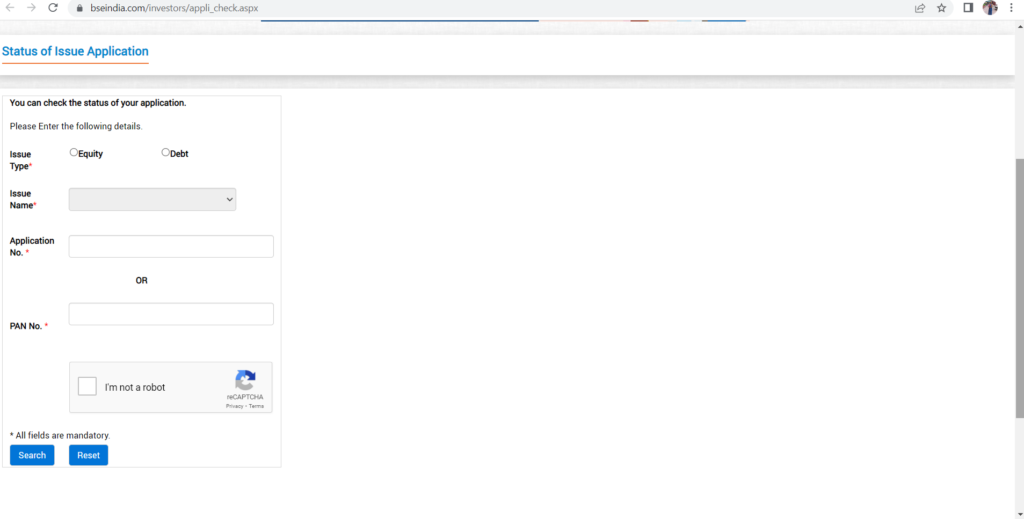

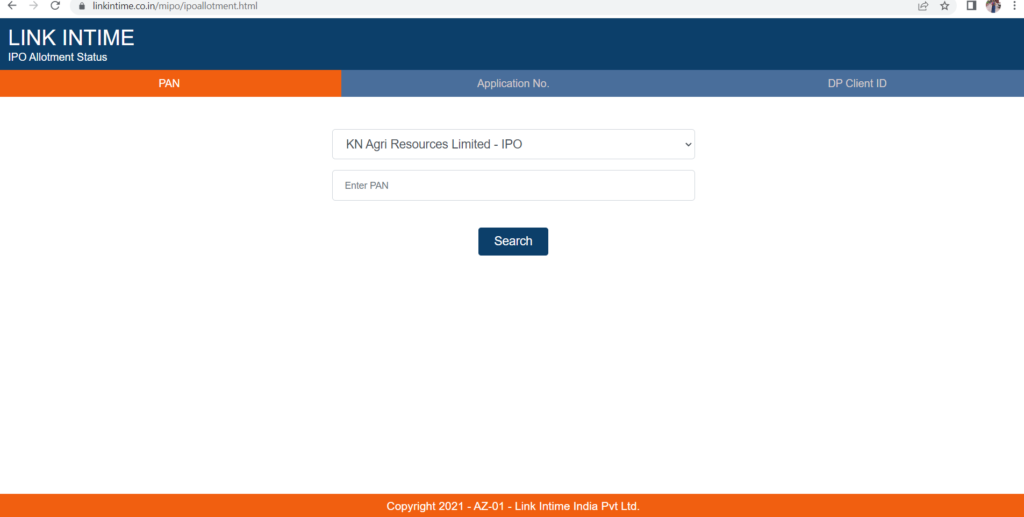

Ruchi Soya FPO allotment status can be checked on the following website, by entering your Pan number

- https://www.bseindia.com/

- https://linkintime.co.in

Bump in Ruchi Soya FPO

Ruchi Soya FPO was sailing smoothly when a bump came in the form of an unsolicited SMS received by the investors, which was reported by Ruchi Soya to IPO.

The SMS said, “Great news for all beloved members of Patanjali Parivar. A good investment opportunity in Patanjali Group. Patanjali Group company—Ruchi Soya Industries Ltd—has opened the follow-on public offer(FPO) for retail investors. The issue closes on 28 March 2022. This is available in the price band— ₹615-650 per share, i.e., a discount of about 30% to the market price. You can apply for shares through your bank/ broker/ ASBA/UPI in your Demat account.”

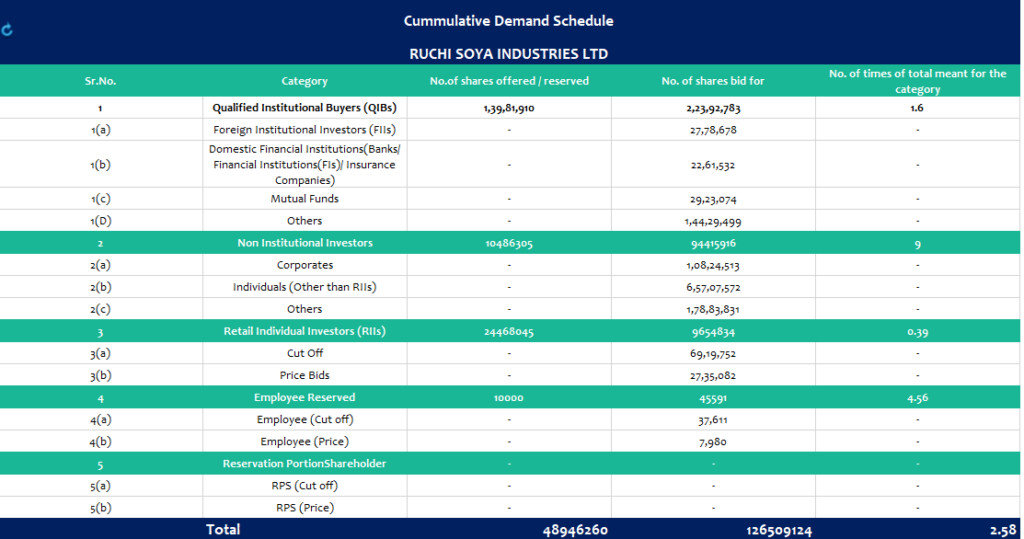

Ruchi soya reported the same to the market regulator Securities Exchange Board of India(SEBI) about the same. Amis this message, SEBI has asked Ruchi soya to allow investors to withdraw their application till 30th March 2022. Following the announcement, total subscriptions fell to 2.58x from 3.6x as investors across categories withdraw applications. Details of same are as follows:-

- A total of 4.95 crore bids have been withdrawn.

- The QIB subscription reduces to 1.6x from a close of 2.2x, 84 lakh bids withdrawn, the

- HNI subscription reduces to 9x from 11.75x, 2.9 crore bids withdrawn.

- The retail subscription reduces to 0.4x from 0.9x, 1.23 crore bids withdrawn

- employee subscription reduces to 4.5x from 7.7x, 32,000 bids withdrawn.

- The SEBI allowed ex-anchor investors to withdraw Ruchi Soya FPO bids.

The updated bid till 10:00 AM 29th March 2022 are as follows:

This step by SEBI to protect the interest of investors might prove to be a disadvantage for the Ruchi Soya FPO listing which is due on 6th April. However, looking at the fundamental and financial numbers of the company, this is certainly a value-based investment for the investors in the coming time.

However, despite all good about the company, no investments in the market are protected from market risk, thus investors must do their research before investing.