Russia is in a no-nonsense mood and has started moving inside the territories of Ukraine, post-Russian President Vladimir Putin announced a military operation in Ukraine early Thursday. Further Mr. Putin also warned other nations, that any attempt to interfere with the Russian action would lead to “consequences they have never seen.” To justify the attack made on Ukraine, Russia said, it was made to protect civilians in eastern Ukraine.

This invasion made by Russia will also attack Ukraine both economically and politically, as it will topple the democratically elected government of Ukraine. Aid this war situation created by Russia in Ukraine is resulting in sanctions levied by various nations on Russia could reverberate throughout the world, affecting energy supplies in Europe, jolting global financial markets.

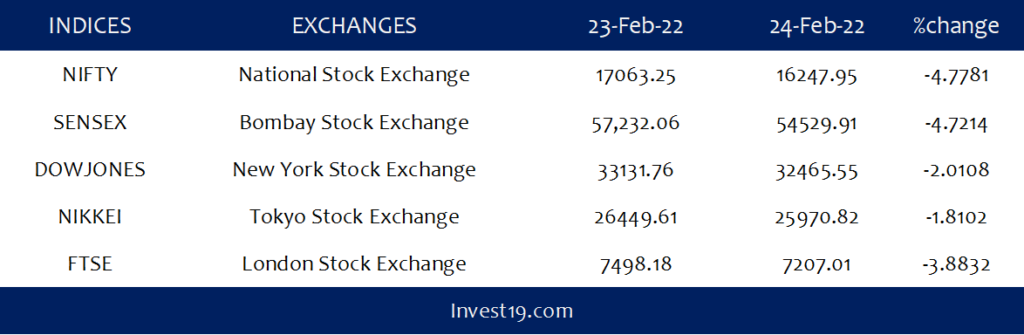

EFFECT ON GLOBAL INDICES

The table given shows a clear blood bath across all the financial streets across the nations. All the major indices, the indicator of financial performance of any country, have lost over 1% to 4% and there doesn’t seem to be any relief till the tension between Ukraine and Russia settles down.

- In India, Nifty and Sensex have lost 4.77% and 4.72%, respectively within a trading session, post Mr. Putin’s announcement of military intervention in Ukraine.

- As per the data, BSE-listed firms lost almost Rs13.32 lakh crores after investor wealth declined to Rs 242.28 lakh crore against Rs 255.68 lakh crore in the previous session.

- Dow Jones has lost over 666 points till 10:30 PM of IST on 24 Feb 2022.

- NIKKEI and FTSE shredded over 1.81% and 3.88%, respectively.

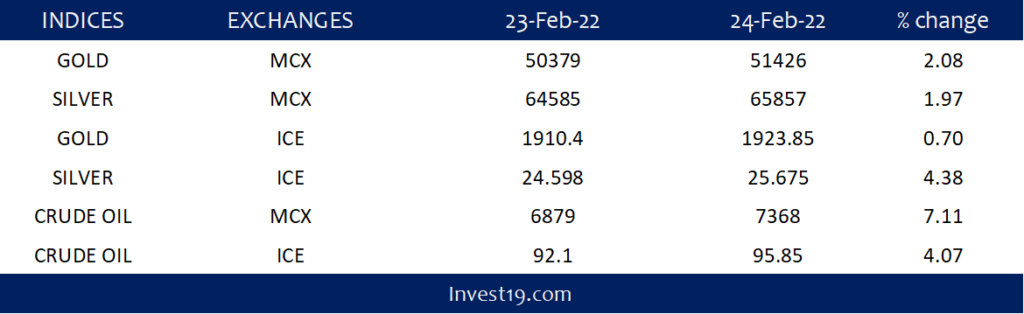

EFFECT ON COMMODITIES

- Commodity prices across the globe have surged amid rising tension between Ukraine and Russia.

- Gold and Silver, in MCX, have gained 2.08% and 1.97%, respectively.

- On the International Commodity Exchange, ICE, Gold, and Silver gained 0.70% and 4.38%, respectively, till 24th Feb 2022, 11:00 PM IST.

- Post-2014, First time in the last 6 years, Crude oil crossed the mark of $100 per barrel on ICE, later to come down to $95.85

WHAT SHOULD INVESTORS DO?

Indian equities are certainly bleeding and are facing the wrath of tension between Ukraine and Russia. However, this is certainly a good time to hold on to good stocks at cheaper rates. This is an opportunity for long-term investors to invest in the market.

We can expect Sensex, which has already slipped below its 20 days exponential moving average of 57704.80, to settle the day at 54529.91 to extend its losses and may touch level 50000, if the Ukraine-Russia tension continues to escalate. This is buying opportunity for long-term investors to do some good shopping in the Indian stock market.

Indian volatility index rose to 33.9725, a level was last seen in July 2020, indicating the highly volatile market. Thus, Investors must do due diligence before investing or making any financial decision.