On these ongoing geopolitical tensions, markets have started reacting and accepting the happening on earth. The ongoing tiff between Russia and Ukraine is heavily weighing on the markets across the world. Pick any stock market, all of it bleeding and eroding off investors’ money.

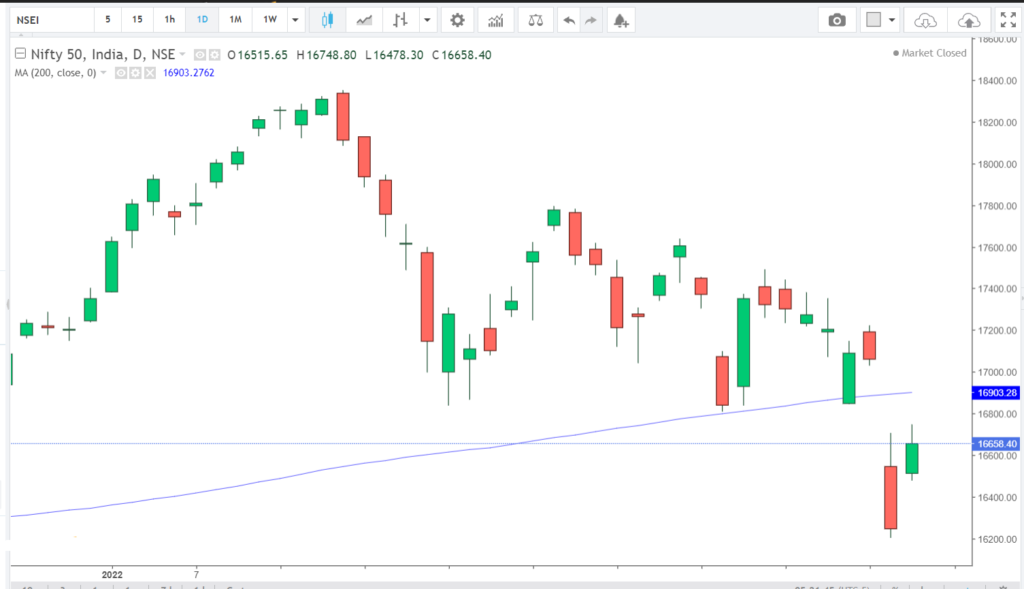

Nifty on weekly basis has lost 617.90 points to close the week at 16658.40 for the week ended on 26th Feb 2022 as against the previous weekly close of 17276.30. On the other hand, SENSEX the second major indices of India shredded 1,972.10 points or 3.41% to settle at 55,858.52.

Major reasons for sluggish movement in the markets are:-

- Ongoing Russia-Ukraine conflict.

- Oil prices shooting above $100 for the first time in the last 6 years.

- Withdrawn by foreign institutional investors.

Ongoing Russia Ukraine conflict

Russia announced a military intervention in Ukraine on Thursday via land, air, and sea. This sent chilling vibes across the financial world amid the chances of a devastating humanitarian crisis. Since Many countries have put sanctions on Russia amid its attitude towards Ukraine. There is also a talk on restricting Russia from the global swift payment system. This has also toned down the chances of any further rate hike by the Fed.

Oil prices above $100 per barrel

Post-2014, the First time in the last 6 years, Crude oil crossed the mark of $100 per barrel on ICE, later to come down to $95.85. Prices have eased amid profit booking at a higher level, however, prices may go up again, if the peace talk between the two nations doesn’t go through.

Withdrawn by Foreign Institutional Investor

As per the data, FII has sold Rs163,405.76 of equity and debt till 25th Feb 2022 and bought equity and debt of Rs 121,634.04 crores making a net sell of Rs Rs41,771.60 crores.

Things to keep in mind for the coming week

MACRO FONT

- The market is expected to react as per the change in the scenario of the Russia-Ukraine conflict.

- India’s fourth-quarter GDP data will be released on 28th Friday.

- Infrastructure output data to be released.

STOCK WISE

- The auto sector is to be in focus as monthly sales of Auto companies for February will start to release.

VOLATILITY INDEX

India’s volatility indicator VIX also rose multi-month high to the level of 33.93 amid the Russia-Ukraine issue, which has impacted all major financial markets.

NIFTY OUTLOOK

Due to ongoing tension between Russia and Ukraine, we can see a high volatile market in the coming week. The market saw a fall of almost 617 points and is currently at the level of 17276.30. On the day, Russia started its military intervention market lost 800 points to close the day at 16247.95 against Wednesday’s close of 17063.25. and buying at a lower level took the market up by 500 points on Friday to settle the day at 17276.30.

Nifty has slipped below its 200day moving average level of 16903.28. A sustainable strength in Nifty is only possible if the index moves past the level of 16900 with consistency. However, any movement below this will take the nifty down towards the level of 16185.

The investor may stay cautious before taking any steps in the market in coming week, as markets are highly volatile and are risky.