Sachin Bansal, the man behind Flipkart, India’s e-marketplace. Flipkart was acquired by Walmart, the biggest retailer, in the year 2018 at a value of $16 billion. Post Walmart’s acquisition of Flipkart, Mr. Bansal exited the firm, of which he owned a 5.5% stake and his net worth during the time was $1 billion.

Sachin Bansal has made his second venture by the name of NAVI founded in the year 2018 with its headquarter in Bengaluru along with Ankit Agarwal.

Details of NAVI

- Former name: BACQ Acquisitions Private Limited

- Renamed as: Navi Technologies Private Limited.

- Industry: Financial Services

- Subsidiaries:

- Navi Finserv – Personal and Home Loans

- Navi Asset Management Company – Multiple, Equity Mutual Funds, Index Funds

- Navi General Insurance – Health Insurance and others

- Chaitanya Micro Finance – Micro Finance and Lending

Within 3 years of its incorporation, NAVI is all set to file for its IPO worth Rs 4,000 crores and is yet to file a draft paper with market Watchdog SEBI. However, if the market is to be believed, Mr. Bansal is all set to files its DRHP anytime this week.

Mr. Bansal owns a 97% stake in the company, but he will not be diluting his stake in the company, so the IPO will be done entirely through fresh issuance of shares with any offer or sale of shares by any existing investors or promoters.

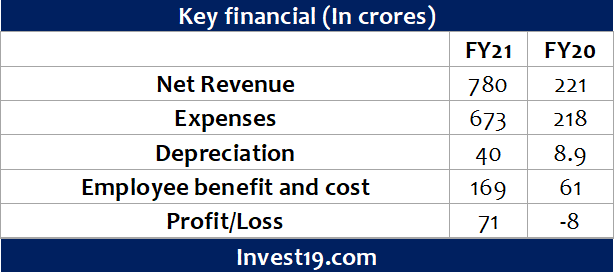

Financial Details

Expected details of IPO

- Issue Size: Rs4,000 crores

- Issue Type: Fresh Issue of Share

- Book Leading managers: ICICI Securities, BofA Securities, and Axis Capital

- Expected Date: June 2022

Investors can look forward to this IPO, as it will be a value-based growth company. But before deciding or investing any money into the market, Investor must do their thorough homework, as markets are subject to uncertain risk.