The Computer Age Management Services (CAMS) is the leader amongst the largest registrars and transfer agents of mutual funds in India, which recently has filed draft prospectus with the SEBI. CAMS is a Chennai based financial service and infrastructure provider which likely to hit the primary market on Monday, September 21. The IPO will be an offer-for-sale (OFS) of 1,82,46,600 shares by NSE investments. The IPO will be closed on September 23.

CAMS IPO Details

| IPO Size | Rs. 2,250 crore |

| Price Band | Rs. 1100-1200 per share |

| Minimum Lot Size | 12 shares |

| Face Value | Rs. 10 per share |

| Employee Discount | NA |

| Retail Allocation | 35% |

| Issue Open Date | September 21, 2020 |

| Issue Close Date | September 23, 2020 |

| Listing Date | October 1, 2020 |

The CAMS is co-owned by the National Stock Exchange (NSE) Investments HDFC Group, Warburg Pincus, Faering, and Capital ACSYS Investments. As mentioned, CAMS is the leading largest registrar; offering solutions to mutual funds and other financial institutions in payment and transaction execution, dividend processing, investor interface, and compliance-related matters. Apart from this, the company also offers customized solutions in KYC registration, electronic payment collections, and software solution business. CAMS has an asset-light business model. Consequently, the earnings are distributed among shareholders. The company has an RoE of more than 25 per cent, high expense ratio, and market leadership position makes it enticing for investors to invest in the IPO shares of CAMS.

However, it would be recommendable to go through some key points before investing in CAMS IPO. The key points are as follow:

- According to the DRHP, the company is India’s largest registrar and transfer agent of mutual funds. The company has an aggregate market share of 69.4% based on Average Asset Under Management (AAUM) during November 2019. Over the last 5 years, the company managed to grow from Rs. 2,180 billion to Rs. 6,643 billion in FY2019.

- Over the years, the company has expanded its product lines and now offering services in six business verticals apart from mutual funds.

- CAMS has an extensive backend network to support extensive operations. As of September 2019, the company had around 278 service centres spread over 25 states and 5 union territories. The company had more than 1300 employed personnel at front offices and more than 5000 at back offices.

- A debt-free balance sheet has helped the company in maintaining consistent profitability.

- CAMS has outsmarted its peers and the company top line’s growth in the last three years implied a CAGR of 20.4%. However, there was a dip in profitability in the current year caused the net income to drops at FY2018 levels. Despite this, the company managed to recover the profitability stood at a robust 18.3%.

SWOC Analysis

Strengths: No matter how big the company is, what kind of operations they perform, which type of customers they target, strengths always come from their promoters background prospects and benefits and type of market structure. The financial infrastructure provider is backed by strong promoters such as NSE, Warburg Pincus, Faering Capital ACSYS Investments and HDFC Group. The asset-light business model of the company will push the company for healthy payout to its shareholders. The company has the advantage of a monopoly market in the listed space.

Weakness: It is hard to find any weakness in the ongoing scenario as the company is not facing rigorous competition from its competitor. The company has captured 70% of the total Average Asset under Management (AAUM) handled by mutual funds. However, the services are provided by the company through the internet increases our exposure to potential cybersecurity attacks including viruses, ransomware and spam attacks. The company has experienced cybersecurity threats to our information technology infrastructure and have experienced non-material cyber attacks. Moreover, any changes in the technology stricter made by SEBI could dampen their survival in future.

Opportunities: There is no denying the fact that Indian economy is less penetrated in the fields of mutual funds and insurance market. The Indian economy is known for following the footprints of western economies in which insurance is a basic necessity and investors are more akin to investment rather than channelizing into banks in the forms of FDs or savings. So there is enough room for the core product of CAMS to flourish in future.

Challenges: The technology-driven companies usually face the turmoil of technology obsolete and changes drawn in the structural work by regulatory authorities. The company will be required to continue its software-development to attain hassle-free operations. On the front of peer comparison, the company faces competition from Karvy Fintech (now named as ‘KFintech’) and Franklin Templeton Asset Management (India) Pvt Ltd. (FTAMIL). While the whole market is dominated by CAMS and KFintech as FTAMIL is restricted to investors of Franklin Templeton Mutual Fund only.

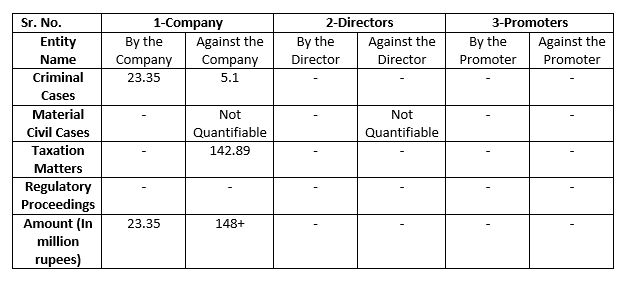

Outstanding Litigation

Financial Statements

Seeing above, we can say that there is no doubt in the performance of the company. The company has a long proven record of accomplishments. The company’s revenue and growth both have shown remarkable growth throughout the years. For more details, it would be recommendable to go through the red herring prospectus. You can also go through the CAMS IPO Details to get deep insights into the company’s performance and financials.