Digital-based food delivery platform is all set to list on the Indian bourses and its popularity is gaining a lot of strength. IPO of Zomato is one of the most-awaited issues in the primary market and it is going to material in July. The aggregator platform has received approval from SEBI and its issue size has been finalized. Issue size of Zomato is a mix of Offer For Sale and Fresh Issue. Offer For Sale is an aggregate of Rs. 375 cr. by Info Edge while the fresh issue of Rs. 9,000 cr. will be utilized for funding organic and inorganic growth.

Products of Zomato

Zomato is a B2C aggregate platform and its core-product is to help

- customers to find restaurants

- Provide reviews by customers to support the food order from any restaurants.

Other products:

Dining Out: Zomato offers dining at some restaurants where dining focuses on three things—a contactless menu, contactless ordering and contactless payment.

Hyperpure: Delivery based operations in which small trucks are filled with neatly packed containers of high-quality fresh produce – fruits, vegetables, grain, poultry, dairy, and fresh meats.

Zomato Pro: Exclusive paid-membership program that unlocks flat percentage discounts for the customers at select restaurant partners across both food delivery and dining-out offerings.

Must Read: ‘One size fits all’ doesn’t work anymore! Every sector has different parameter to scrutinize.

Investor’s response for Zomato IPO

Market participants are betting on the success of Zomato issue due to strong growth drivers and funding by various institutional investors. Rising penetration of smartphones in the Indian market and a country with 2nd largest population claims to provide strong growth to a food delivery platform perpetually. Zomato is backed by big institutions and involvement of various investors display strong future prospects of the business. It is worth mentioning that the company has not been able to generate profits. Well, futuristic digital platform startups usually display losses in early years due to high expenditure on advertising and lucrative schemes to attract customers and largely bank upon funding from institutional investors to augment their capital requirements.

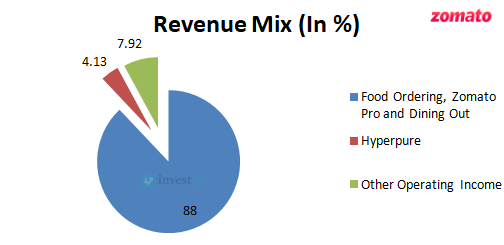

Revenue Mix of Zomato

Total Revenue: 2,604.73 crores

- 2,290.8 crores/88% revenues from sale of services from platform such as Food ordering, zomato pro and dining out.

- 107.58 crores/4.13% revenues from delivery of traded goods such as ‘Hyperpure’.

- 206.34 crores/7.92% revenue from other operating income.

Per Unit Mathematics of Zomato and it is profitable

| Per Order Mathematics of Zomato | FY20 | FY21 |

| Gross Order Value (Rs. In millions) | 112209 | 94827.8 |

| Total Orders (Millions) | 403 | 238.9 |

| Average Order Value | 278 | 397 |

| Restaurant partner’s commission | 43.6 | 62.8 |

| Customer Delivery Charges | 15.3 | 27 |

| Total Revenue | 58.9 | 89.8 |

| Delivery Cost | 52 | 45.7 |

| Discount | 21.7 | 8.3 |

| Other Variable Cost | 15.7 | 15.3 |

| Total Varable Cost | 89.4 | 69.3 |

| Contribution (Per Unit) | -30.5 | 20.5 |

- Commissions from restaurants for fetching business in the form of food order has surged from Rs. 43.6 to Rs. 62.8, an increase of 44% shows the rising Zomato’s strength of bargaining on restaurants.

- Customer delivery charges are increased from Rs. 15.3 to Rs. 27, which states that Zomato is operating with higher efficiency.

- Delivery cost has been reduced from Rs. 52 to Rs. 45.7 clears that Zomato is efficiently reducing their cost by maintaining their delivery partners.

- Initially, Zomato has offered heavy discounts on food orders to attract customers. However, company has reduced their discount cost from Rs. 21.7 to Rs. 8.3 as customers are become habitual to food ordering.

- The theoretical framework of Variable costing has turned Zomato profitable on per order basis.

Zomato’s Annual Results

| Income Statement (In Millions) | FY21 | FY20 | FY19 | FY18 |

| Gross Operating Income | 21184.24 | 27427.39 | 13977.20 | 4045.63 |

| Cost of Employee & Inventory | 9326.34 | 9078.01 | 6173.78 | 2904.93 |

| Other Expenses | 15283.22 | 40016.38 | 29386.91 | 2679.75 |

| EBITDA | -3425.32 | -21667 | -21583.5 | -1539.05 |

| Depreciation | 1377.44 | 842.36 | 431.15 | 291.47 |

| Interest | 100.82 | 126.36 | 86.89 | 63.49 |

| Exceptional Items | -3247.67 | -1220.29 | 11999.2 | – |

| Profit Before Tax | -8151.25 | -23856 | -10102.3 | -1894.01 |

| Tax | 13.04 | – | – | – |

| Profit After Tax | -8164.29 | -23856 | -10102.3 | -1894.01 |

- Zomato’s gross revenue has increased at a CAGR of 73% in last 3 years. Revenues have been declined this year due to restrictions on movement of men, materials and machine imposed by government to contain COVID-19.

- The company has reduced their spending heavily on promotions and advertising and digital marketing. As a percentage of total income, the advertisement and sales promotion expenses were 24.88% in FY2021 compared to 48.80% in FY2020.

- Other Expenses of the company includes Advertising and Sales promotion expenses are plunged by 61.8% that has narrowed down the losses of the firm.

- EBITDA figure is still negative at Rs. 3,425.32 million; however it has narrowed down by 84%.

- Net Losses are narrowed to Rs. 8,164.29 million from Rs.23,856 million.

- The digital food delivery platform has free cash flows of Rs. 306.5 cr. and additional capital infusion of Rs. 9,000 cr. from net proceeds of fresh issue will support their operations further.

- Zomato is a loss-making platform therefore valuation parameters are limited. Still, the Enterprise Value/Sales stands at 20.5x while the unlisted peer Swiggy and global peer Amazon-backed British food delivery firm Deliveroo is trading at 7.5x and 4.4x respectively.

Also Read: Why should you stick to investing in market leaders only?