Campus Activewear Incorporated in the year 2008, by the founders Hari Krishan Agarwal and Nikhil Aggarwal, is all set to launch its IPO to raise an amount of Rs1400.14 crores.

Campus activewear, in FY21, is the largest sports and athleisure footwear brand in India in terms of value and volume. The campus has an expansive pan-India reach that enabled the firm to sell 12.26 million, 14.36 million, 13.00 million, 2.68 million, and 7.05 million pairs in Fiscals 2019, 2020, 2021, and six months ended September 30, 2020, and September 30, 2021, respectively.

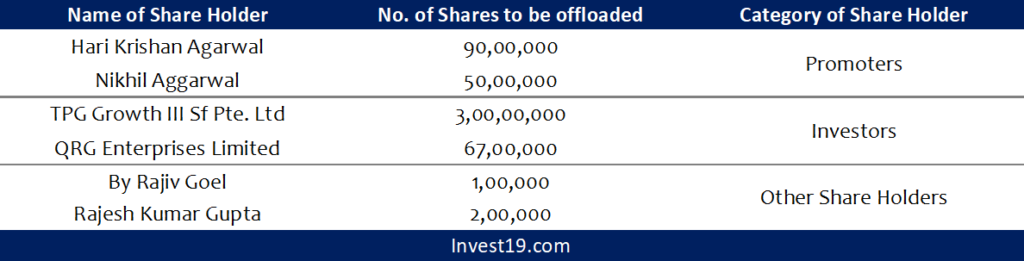

The initial public offering of the company is an entire offer for sale, where promoters are shedding -51,000,000 equity shares.

Details of Share to be sold by shareholders

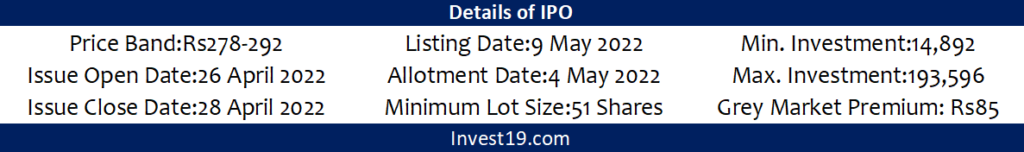

Details about the IPO

Financial of Campus

- Campus reported ₹300.86 million net profit till Sep’2021 which is 1.11 times more than the net profit earned in the previous fiscal.

- Operating income in FY21 is reported at ₹7,150.80 million against ₹7341.15 million earned a year ago.

- Reduction in finance costs and tax expenses led to higher profit in the first eight months of FY22.

Allotment of the CAMPUS IPO

What Should Investors Do?

The campus is a lifestyle brand in the active wear category. It has shown massive progress in the last 3 financial years. With the continuous increase in the demand for athleisure wear, the company is set to grow.

It’s a growing company and investors may look at the IPO for long-term perspective as well as for listing gains as Grey market premium is constantly rising. The grey market premium has touched Rs85 above the higher side of the price band i.e Rs292.

However, investors must do their research before investing in the market. As IPOs may be risk-free but they are launched in the market which is subject to risk.

How to apply for the IPO?

Click on the link given to apply for the CAMPUS IPO at your finger points.