After a stellar subscription status of Devyani Int., Krsnaa Diagnostics, Exxaro Tiles and Windlas Biotech investors are gathering funds for the IPO of online automotive platform ‘Car Trade’. This is the 5th IPO in the month of August. The automotive e-commerce platform operates several brands: CarWale, CarTrade, Shriram Automall, BikeWale, CarTrade Exchange, Adroit Auto and AutoBiz. The issue size is a complete offer for sale. The e-commerce platform is profitable and expected to fetch the sight of a lot of institutional investors.

Car Trade IPO Details

- Issuer Company: Car Trade

- Industry: E-Commerce

- IPO Size: 2,998.51 cr.

- Price Band: 1585-1618

- Issue Open Date: 09 Aug, 2021

- Issue Close Date: 11 Aug, 2021

- Listing Date: 23 Aug, 21

- Minimum Lot Size: 9 shares

- Face Value: 10 Rs. Per share

- Employee Discount:

- Retail Allocation: 35%

- Listing Exchange: NSE, BSE

Composition of Issue Size

The issue size of Rs. 2,998.51 cr. is a complete offer for sale. The object of the Offer for Sale is to allow CMDB, Highdell Investments, Mac Ritchie Investments, Springfield Venture International and others to sell an aggregate of up to 18.5 million equity Shares held by them amounting at Rs. 2,998.51 cr. The company will not receive any proceeds from the Offer for Sale.

About the Company

The process of buying vehicles requires buyers to go through several channels and numerous stages. The multiplicity of transactions creates potential inefficiencies and negatively affects the margins of the seller that can be achieved on the sale of a vehicle physically. Therefore, an online automotive marketplace that can bring the buyers and sellers together and match the right vehicle buyers and vehicle sellers on a single platform possess a great opportunity.

Must Read: Devyani Int. has hit the market! It’s time to deep dive into its financials.

Car Trade is a multi-channel auto platform with coverage and presence across vehicle types and value-added services. The platforms of Car Trade operate under several brands: CarWale, CarTrade, Shriram Automall, BikeWale, CarTrade Exchange, Adroit Auto and AutoBiz. Through these platforms, the company enables new and used automobile customers, vehicle dealerships, vehicle OEMs and other businesses to buy and sell their vehicles in a simple and efficient manner. Their vision is to create an automotive digital ecosystem which connects automobile customers, OEMs, dealers, banks, insurance companies and other stakeholders.

Industry Growth Drivers

- India’s Gross National Income per capita is expected to grow at a CAGR of approximately 11% between the calendar years 2020 and 2025.

- Internet and smartphone penetration in India has nearly doubled from 2015 to 2020. By 2025, India is expected to cross 950 million internet users and 800 million smartphone users.

- According to Auto Gear Shift India 2020, over 92% of the buyers of new and used cars research online.

- Government policies such as ‘Make in India’, FAME (faster adoption and manufacturing of hybrid and electric vehicles) and Production-Linked Incentive (“PLI”) schemes will support automotive industry.

- In India, the parc turn rate, which is the total number of used cars sold divided by the total volume of cars, is approximately 16%. Used car market in India is relatively smaller than other countries.

- Used car market in India is expected to grow at a CAGR of at least 11% in the next five years.

- Used two-wheeler market is expected to grow at a CAGR of at least 8% predominantly run by the unorganized sector.

- In 2020, 17% of used cars were purchased with auto finance, compared to 75% for new cars. Auto finance, in pre-owned vehicles market, is a highly under-penetrated market thus has potential for growth.

Peers Comparison

The company has no listed peer.

Financials

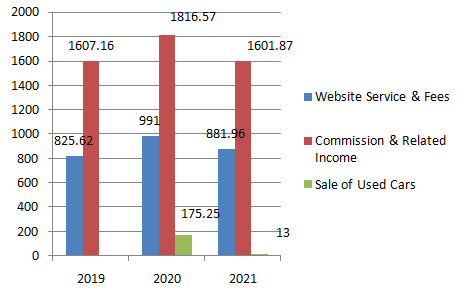

Revenue from operations (Rs. in millions)

Observations

- Total revenues of the company have marginally increased by 2.72% in last two years.

- Revenues have plunged by 11.6% on yearly basis.

- Car Trade generates 64% of their revenues from the Commissions on generating sales of new and used vehicles from OEM (Original Equipment Manufacturer), dealers and retailers.

- The online automotive platform generates 35% of their revenues from website services such as lead generation and fees from providing auction facility and inspection and valuation of used vehicles facility.

Financial Statements

| Income Statement (In Millions) | FY21 | FY20 | FY19 |

| Gross Operating Income | 2815.23 | 3184.45 | 2668.05 |

| Cost of Employee & Inventory | 1313.63 | 1502.18 | 1276.10 |

| Other Expenses | 789.59 | 1084.41 | 861.65 |

| EBITDA | 712.01 | 597.86 | 530.3 |

| Depreciation | 199.27 | 173.82 | 152.18 |

| Interest | 42.98 | 34.89 | 23.81 |

| Profit Before Tax | 469.76 | 389.15 | 354.31 |

| Tax | -540.98 | 76.21 | 95.14 |

| Profit After Tax | 1010.74 | 312.94 | 259.17 |

- Company’s revenue is marginally increased by 2.72% in last two years.

- EBITDA margins of the company stood at 25.3% in FY21 increased from 18.8% in FY20.

- Company has free cash flows at Rs. 22 cr. to operate its functions smoothly.

- The firm has no debt at all; however its interest payments are directed to lease liabilities.

- PAT grew by 222% in FY21 on account of deferred tax credit.

- Return on Equity or Net Worth is 5.43%

- Enterprise value of the company is 7,393 cr.

- EV/Sales of the company stood at 26 times while EV/EBITDA is 103.83x.

- Considering the upper price band at Rs. 1,618 and FY21 Earning Per Share (EPS) of Rs. 22.09, the company is demanding a P/E multiple of 73.24x.

Also Read: Paytm and Mobikiwk filed their DRHP to market regulator SEBI