Devyani International- an operator of finger licking good KFC, cheesiest Pizza Hut and brewed Costa Coffee Quick Service Restaurants (QSRs) is available for subscription now. The IPO has been fully subscribed on the first day which shows the stellar response of investors towards the delicious IPO. Earlier, the management of Devyani Int. had filed their DRHP with an issue size of Rs. 1,838 cr. The issue size is a mix of fresh issue of Rs. 440 cr. and offer for sale of Rs. 1,398 cr. at the upper price band.

Under the Offer for Sale, Dunearn Investment Pte. Ltd. and RJ Corp are reducing their stake while the net proceeds from fresh issue will be utilized for repayment/prepayment of certain borrowings.

Brands under Devyani International

Devyani International is the largest franchisee of Yum Brands in India. The firm is amongst the largest operators of quick service restaurants (QSR) in India and operates 655 stores across 155 cities, as of March 31, 2021. Their business is broadly classified into three verticals that include stores of KFC, Pizza Hut and Costa Coffee operated in India referred to as ‘Core Brands’ while brands such as Vaango and Food Street referred as their ‘Other Business’.

Must Read: KFC, Pizza Hut and Costa Coffee operator Devyani Int. IPO will hit the primary market on Aug 04.

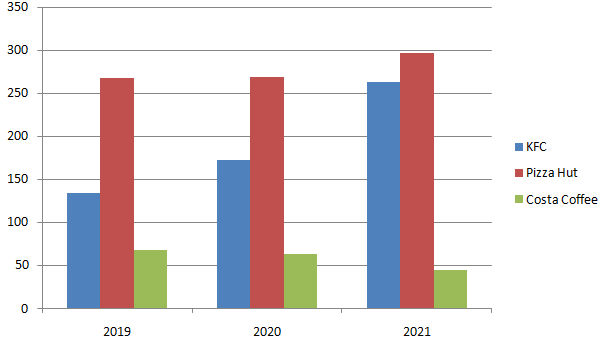

Growth in Core brand Outlets

Observations:

- Growth in KFC stores is outperforming other core brands. KFC stores have seen a growth rate of 40%

- Growth in Pizza Hut stores seems sluggish. The company has opened only 29 stores.

- Costa Coffee stores are closed heavily and company seems to focus mainly on KFC and Pizza Hut stores.

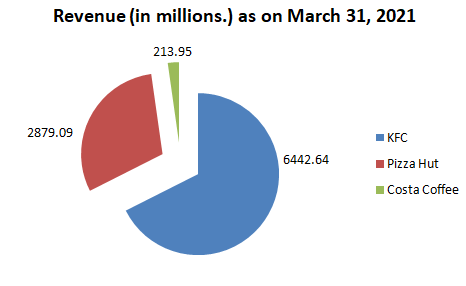

Break-down of revenue from core brands

- Company generates 81.5% or Rs. 9,776.06 million of their total revenues from the Core Brands- KFC, Pizza Hut and Costa Coffee.

- KFC generates 66% of the revenues from the Core brands.

- Same store sales growth has fallen sharply last year in KFC, Pizza hut and Costa Coffee by 33.69%, 30.25% and 61.64% respectively.

Financial Statements

| Income Statement (In Millions) | FY21 | FY20 | FY19 |

| Gross Operating Income | 11988.95 | 15350.41 | 13236.83 |

| Cost of Employee & Inventory | 4989.92 | 6858.81 | 5804.39 |

| Impairment of Non-Financial Assets | 480.05 | 38.77 | 247.53 |

| Other Expenses | 4089.18 | 5750.21 | 4511.97 |

| EBITDA | 2429.8 | 2702.62 | 2672.94 |

| Depreciation | 2294.53 | 2233.14 | 2028.26 |

| Interest | 1528.03 | 1584.37 | 1356.04 |

| Profit Before Tax | -1392.76 | -1114.89 | -711.36 |

| Exceptional Items | -568.84 | -345.78 | -131.48 |

| Tax | -10.68 | 18.41 | 13.02 |

| Profit After Tax | -813.24 | -787.52 | -592.9 |

- Revenues have been declined in FY21 by 22% due to reduced spending by people and restrictions on movement of man, material and machines this financial year.

- Majority cost of a food retail chain is allocated to cost of raw foods which has been slipped by 24.52%.

- Employee cost of the company has fallen by 31.5%.Cost of Employee & Inventory is slipped more in comparison with revenues which shows an operational efficiency is achieved by firm.

- EBITDA figure is fallen to Rs. 2,429.8 million reduced by 10%.

- Net Losses are expanded to Rs. 813.24 million from Rs.787.52 million.

- QSR chain has a free cash flows of Rs. 1,419.82 million

- Devyani Int. is a leveraged company as it has a debt of Rs. 359.38 cr.

Comparative analysis with other listed QSR chains

| Paramenters (Figures in cr.) | Devyani International | Jubilant Foodworks | Westlife Development | Burger King | Barbeque Nation |

| Enterprise Value | 10702.04 | 48598.26 | 8519.7 | 7036 | 4000 |

| Sales | 1134.8 | 3312 | 986 | 494.4 | 507 |

| EBITDA | 227 | 771 | 47 | 15 | 92.43 |

| EV/Sales | 9.4 | 14.7 | 8.6 | 14.2 | 7.9 |

| EV/EBITDA | 47.1 | 63.0 | 181.3 | 469.1 | 43.3 |

- Jubilant Foodworks is the only profitable firm amongst the listed QSR chains.

- Considering the price band, Devyani Int. IPO is going to list with an Enterprise value of Rs. 10,702 cr.

- EV/Sales of the company stood at 9.4x much lower than the Domino’s operator Jubilant Foodworks and Burger King India while Barbeque Nation claims lowest at 7.9x followed by Westlife.

- EV/EBITDA of Devyani Int. stood at 47.1x much lower than Jubilant Foodworks, Westlife and Burger King while a little higher than Barbeque Nation.

Also Read: Krsnaa Diagnostics IPO will hit the primary market on Aug 04. Should you subscribe?