Dozens of talks, meetings among nations, hundreds of sanctions on Russia and Russian diplomats, doesn’t seem to be playing any role. It feels the words of various nations, its leader, Russian own population, UN’s is falling on deaf ear. Russia is in no mood to stop till it achieves its mission.

In midst of all these, Ukraine also made its point clear by applying for European Union membership. On 28th Ukrainian President, Volodymyr Zelenskyy signed an application seeking membership of the European Union for his war-torn country, hours after asking the European bloc to allow Ukraine to become a member under a special procedure “immediately” as it defends itself from invasion by Russian forces.

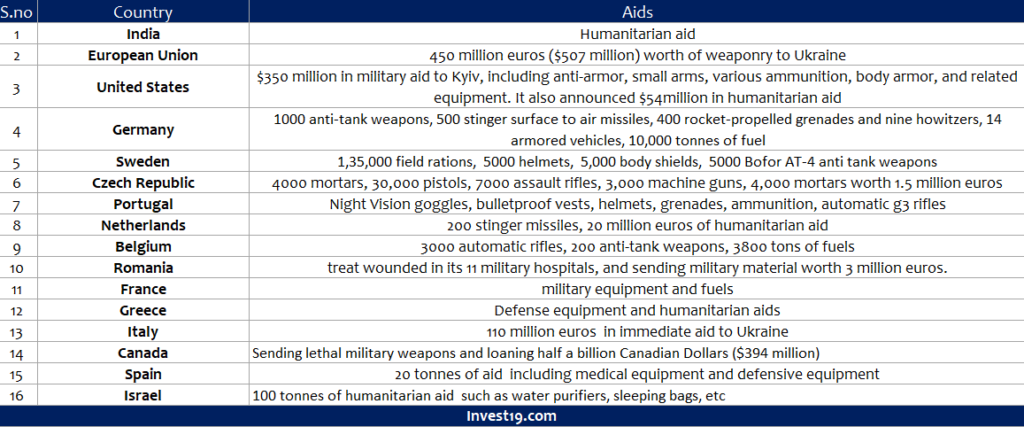

Ukraine is in a strange position to the country has come forward to help the warn country directly, but they are trying to political and economic pressure on Russia by use of sanctions and also by providing military and humanitarian support to Ukraine.

The outcome of the war may sway in any direction, but it is certainly weighing heavily on the financial market across the world. All major financial indices are sulking amid ongoing geopolitical tension.

Dollar Index

After yellow metal, it’s the green bucks, i.e dollar which is considered to be one safe asset to hold during unrest in the world. Since the day Russia started its military intervention in Ukraine, the Dollar index, rose to 97.832 as of 2nd March 2022 from the level 95.835 witnessed on the 23rd Feb 2022, making it a surge of 2.08%.

Nifty Outlook

Nifty, since the day war started has corrected over 741 points, till 3rd march low of 16478.65. Nifty took a deep downfall to touch 16,203.25, just a day after the war started. However, buying at a lower level gave some cushion to the deep fall and pulled nifty above the level of 16400.

But Nifty50 has come down below its 200 days EMA of 16709.26 and has breached the lower band of Bollinger at 16434, but currently hovering near the same.

With rising tension and no outcome from the second day of peace talk between Russia and Ukraine and Russia entering the second city of Ukraine, i.e Kharkiv is a grave concern for the market tomorrow.

Nifty, if it falls below the level of 16,400 then there won’t be any stopping in fall before the level of 16,000. However, if the market can sustain its today’s close level of 16,478.65, then Nifty can be seen trading with a positive bias, but sustainability can only be achieved on a successful breach of 16,500 and consistent trading above the same.

Market Volatility

However, the investor must stay cautious before making any move in the market, as India’s volatility index is also seen rising for two consecutive days to the level of 30.8425. Markets are highly volatile; trading is certainly risky. But it is certainly a chance to add value stocks to the portfolio at cheaper rates.