The stock market of Asia’s third-largest economy i.e. India has bounced back to the bull territory when the stocks jumped more than 3 per cent tracking positive global cues on Thursday, April 30, 2020. If we take a look at the last week’s market, the domestic indices – NIFTY & SENSEX succeed in trimming some losses since February when the stock market first went into panic mode.

The domestic shares extended gains for the fourth straight session and the strength was witnessed in the day-by-day closing of indices on higher than high-levels in the market.

Thursday’s advance has helped NIFTY to reach the intraday high of 9889.05 levels and made close to 9859.90 levels at the end-of-the-day. However, under normal circumstances, the market should be in correction phase by now but it isn’t. It means, investors’ confidence has been lifted and they are holding onto their investments instead of profit booking in expecting that the rally will continue in future.

In our previous article, we forecasted an up rally in the market near the levels of 8,500 and given investment target of 10,000 levels. The prediction was right as the market is around 9800-9900 levels. But, the coronavirus is still looming over the capital markets and the latest forecast depicts that the market is yet to see the worse.

As per the Kaushlendra Singh Sengar, Founder & CEO @Invest19, “The weakness in the coronavirus dented-market will deepen further in future and on Monday, May 04, 2020, the SENSEX is likely to see a correction of more than 2000 points.”

While at it, he also mentioned that the market is standing at the high and the current levels could be the next 52-weeks high for domestic indices.

Below he has shared his opinion on the economic outlook and stock market outlook for coming days.

Global Economic Outlook

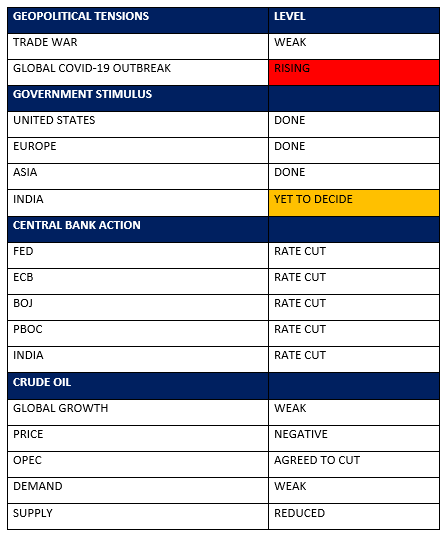

On the global economic impact, Mr Kaushlendra Singh Sengar said it is becoming clearer due to the pandemic and this hit hard the global as well as domestic equity markets. Lockdown across the globe has disrupted the economies and it is being estimated that global GDP which may be shrunk by more than 1%. On the other end due to closed economies & business around the globe world can go into a deep recession. The COVID-19 outbreak in China has disrupted global supply chains as quarantine and lockdown measures are following to control the spread of the virus. As a result, India is among the top 15 economies which will most be impacted by the corona-related production slowdown around the globe.

Major Concerns may lead the world in the Great Recession

Increasing concerns of CoronaVirus.

However, considering the current circumstances and visible indications of an economic slowdown in India, increasing the number of infected cases and death rates, expectations to extend the lockdown measure further from 3rd May signalling Indian equities are firmly entering into a bear market as the market anticipated more than a month of lockdown in India the GDP growth rate maybe 2.1% in negative at the end of June this year, which would be lowest GDP rate in nearly 41 years. While, virus relief stimulus package is yet to decide between FM and PM, headlines as on 26th April. Meanwhile, the World Health Organization (WHO) warned about the Coronavirus stating it will remain extremely dangerous and there is no sign of the end of this pandemic any soon.

Panic in the Oil Market.

One more recent historic collapse in oil prices added to fears of a virus-induced recession whereas the May WTI contract closed at -$37.6 per bbl, the first negative settle ever i.e, on 20th April 2020. Negative oil prices mean that producers are effectively willing to pay someone to move their crude amidst on-going COVID-19 disease raised demand destruction and the storage constraints at Cushing, which is expected to enter the recessionary zone in 2020 as countries have shut down business activity to fight the COVID-19 pandemic.

Wiped out liquidity in the market and the mini bubble will explode.

In a signal that India’s high-rated companies are planning for the long pull, they are choosing for a moratorium on debt servicing. Experts say the focus is on safeguarding liquidity as there is uncertainty over the duration and influence of the more than a month-long countrywide lockdown enforced to stop the spread of the pandemic.

Senior Managers from the rating industry, who have been obtaining reports from companies, say some companies with ratings as high as ‘AAA’ have also opted the option for a moratorium. Companies have a higher rating for their capabilities to service debt on time.

US threatening of enforcing new tariffs on China amid Coronavirus.

The recent news from the US administration can also take the market on the downside. U.S. President Donald Trump said on Thursday his trade deal with China was now of lesser importance than the coronavirus pandemic and he warned new tariffs on Beijing, as his administration constructed retaliatory actions over the outburst.

Trump’s whetted speech against China signalled his escalating frustration with Beijing over the pandemic, which has cost tens of thousands of lives in the United States only, triggered an economic contraction and warned his prospects of re-election in November.

Rising Jobless Claims Data.

First-time ever this many people of US claimed for unemployment insurance which stands at 3.84 million yesterday as the surge of economic pain persists, even though the worst looks to be in the past, according to Labor Department figures Thursday. Economists surveyed by Dow Jones had been looking for 3.5 million. Jobless claims for the week ended April 25 came in at the lowest level since March 21 but bring the rolling six-week total to 30.3 million as part of the worst employment crisis in U.S. history.

Last but not least.

As per one of the newspapers of the UK raised concerns about WORLD WAR 3 fears can to be explored across the globe just a few days into 2020 and now they have been triggered again. The US-China relationship has been particularly strained in recent years. A trade deal between the two countries would seem to alleviate some tensions but implementation remains in question. Currently, the world’s two largest economies are locked in a bitter trade battle. The dispute, which has simmered for nearly 18 months, has seen the US and China impose tariffs on hundreds of billions of dollars, worth of one another’s goods. Now as per the sources US administration again planning to enforce some tariffs on China.

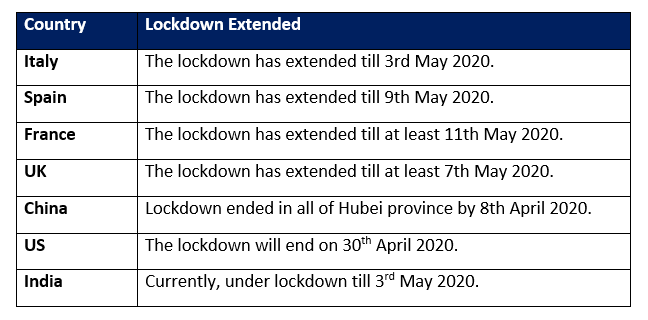

Extensions on Covid-19 lockdowns across the world

One more recent historic collapse in oil prices added to fears of a virus-induced recession whereas the May WpTI contract closed at -$37.6 per bbl, the first negative settle ever i.e, on 22nd April 2020. Negative oil prices mean that producers are effectively willing to pay someone to move their crude amidst on-going COVID-19 disease raised demand destruction and the storage constraints at Cushing, which is expected to enter the recessionary zone in 2020 as countries have shut down business activity to fight the COVID-19 pandemic.

GLOBAL MACRO OUTLOOK: THE PERSPECTIVE TO JUSTIFY CURRENT SCENARIO

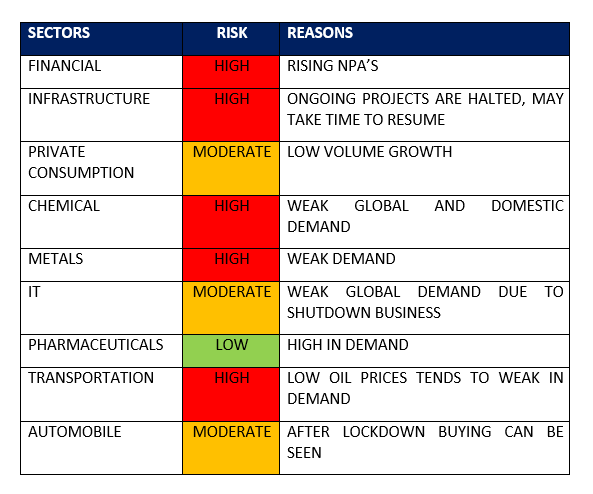

INDIAN SECTORAL OUTLOOK: THE PERSPECTIVE TO JUSTIFY CURRENT SCENARIO

Technical Aspects

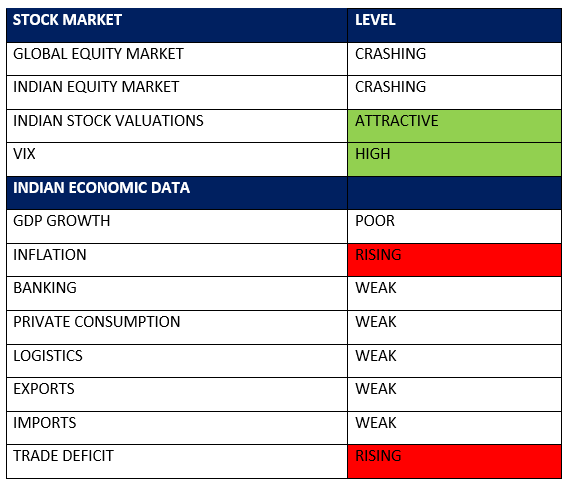

Moreover, Kaushlendra Singh Sengar said technically the market aspect that the numbers of Indian benchmark Indices, as we all know Nifty has already lost over one-third of its value from highest closing levels of 12,352 recorded on 14th January 2020 to 7,511 levels marked on 24th March 2020. The Nifty Midcap100 index has fallen more than 38% during this period and VIX (Volatility Index) has surged over 600%, which is the highest level since 2009 that has already created pressure in the market. After working on the current scenario, technically on the monthly chart, the Fibonacci retracement in Nifty from the year October’ 2008, which is considered as a financial crisis to January 2020 where Covid-19 pandemic occurred, the 61.80% is one of the important levels, which acts as a major support level for the Index that is placed around 6,150. So, we can say that Nifty may retrace to the downside levels of 6200 and 6100 respectively. Additionally, the indicator 200-days simple moving average is also indicating that the Nifty may slip to the levels of 6,150. Indicator, ADX line is trading above 24.35 signals the potential strength on the trend. Hence, we can assume that the worst-case Nifty level of 6,140 and best-case scenario of 10,000.

As per the above-given chart, rising wedge is formed on the daily chart. Once market will close below the horizontal line as once the level of 9250 will breach on the downside successfully then the market will give steep fall and as per the given indicators, it will fall to aforesaid levels of 6150 marks.

The COVID-19 pandemic continues to make headlines as on the 1st May 2020 around the globe total no. of infected rose to 3.26 million & it claimed more than 2.33 lacks lives around the globe. The US can be said currently an epidemic centre with total cases crossed 1.1 million and in the USA only it claimed 63,700 lives there. China the mainland reported 84,373 total cases while 4,643 total causalities. India is gradually falling into the swamp. According to Ministry of Health and Family Welfare data of India, the total number of cases in India has crossed 35,000 as of May 01, including more than 26,000 active cases, 1147 deaths, with almost 9,000 cured or discharged patients.

Now finishing the story with the question, that what kind of a world or economy can we expect after the pandemic?

Before this Covid-19 pandemic, the global economy has already faced severe problems from World War I to SARS, Avian Influenza, Ebola to Zika epidemics, the market has always overreacted to the crisis, as a result, steep valuations of the benchmark indices have been observed, which has left investors worried. But this is pandemic and in history worldwide lockdown happens for the first time. History repeats itself; this is the time-tested period for investors and the market to investing success. Hence, we recommend you make your investing decisions strategically because the current recovery of 15% in Indian equity from 7500 levels to 9800 levels is a trap as Nifty chart is forming ‘Deadcat’ bounce, which is a temporary recovery. If we go back to the 2008 recession, we check the same scenario after a bounce-back the market has witnessed a steep fall and entered into the bear zone. So be careful before you deploy your cash unnecessary at this higher 9,800 levels.