Latent view analytics is a leading data analytics service company in India. It has made its leading position within 15 years, because of its expertise of the entire value chain of data analytics and analytics consulting to business analytics and insights, advanced predictive analytics, data engineering, and digital solutions. Firm expertise in business analytics includes analytics concerning customer profiling, targeted marketing, supply chain management, finance and risk management, and HR functions.

The latent view analytic IPO is all set to rise to Rs600 crores, of which Rs 474cr is a fresh issue and Rs 126cr for an offer for sale. The firm will not receive any proceeds from the offer for sale, however, the net proceeds from the fresh issue will be utilized for funding inorganic growth initiatives; funding working capital requirements, and investment in subsidiaries to augment their capital base for future growth apart from funding general corporate purposes.

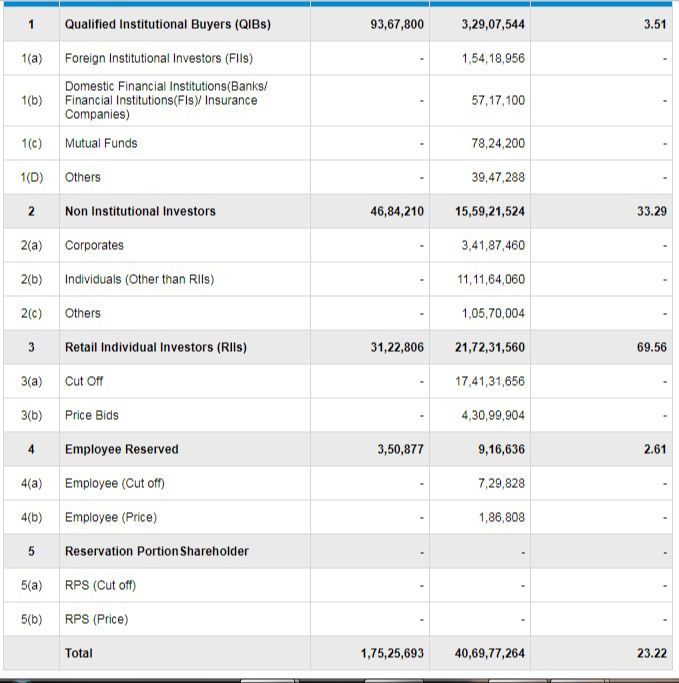

The IPO window opened for 3 days from 10th November to 12th November 2021. Till the 2nd day of bidding the firm has already received bids for 40.69 crores against the Latent View analytics IPO size of 1.75crores. Qualified investors have already received bids 3.51 times of its reserved shares, Non institutional investors received bids 33.29 times, whereas retail investment was received subscriptions 69.56 times.

If the investor is allotted shares, the shares will be credited to the investor’s account on 22nd November 2021. In case of non-allotmnet, the refund will be initiated on 18th November 2021. The Latent view analytics IPO will be listed on 23rd November 2021 on both NSE and BSE. IPO is garnering some popularity in the grey market as well. Latent view analytics IPO GMP is approximately at Rs290( there is no official platform for the grey market). If the IPO goes in line with grey market premium the latent view analytics is expected to list at least at a premium of 80%.

On the financial front, there was a continuous rise in net profit from year on year. The firm reported a net profit of Rs916.43 million up by 25% from the previous year’s PAT of Rs728.45 million. Cash profit margin went up to 32.15% from 25.62% in Fy2020. Atent view nalytics is a financially sound company, and the fundamentals are also in favor f the firm.

However, investing in the market must be done with due diligence. Thus every investor must do their research before investing.