For the first time in India, a laboratory plastic ware equipment maker, Tarsons Products, is all set to launch its IPO to raise Rs 1023.47crores. The firm Tarsons Products Limited incorporated in the year 1983, located in the city of joy, Kolkata, is engaged in the designing, development, manufacturing, and marketing of ‘consumables’, ‘reusable, and ‘others’ including benchtop equipment, used in various laboratories across research organizations, academia institutes, pharmaceutical companies, Contract Research Organizations (“CROs”), Diagnostic companies and hospitals.

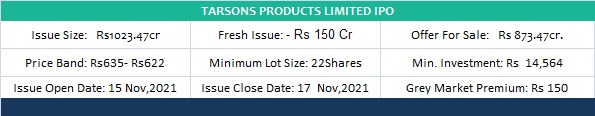

The Rs1203.47 crores IPO consists of a fresh issue of Rs150 crores. The firm will raise873.47 crores through an offer for sale. Under offer for sale, the promoters, Sanjive Sehgal and Rohan Sehgal to shed 3.9 lakh shares and 3.1 lakh shares, respectively. Another investor of the company Vision Investments holding PTE limited to shed a chunk of 1.25 crores shares.

35% of the total IPO is reserved for retail investors and 50% for qualified institutional buyers and 15% for non-institutional buyers. The issue will have 60,000 shares reserved for its employees. The minimum investment required for a retail investor is Rs 14,564 and the maximum investment possible by a retail investor is Rs 189,332. Investors can apply for a minimum of 1 lot, having 22 shares.

The IPO will open its window for bidding from 15th November2021 and it will close on 17th November2021. The basis of allotment will be done on 23rd November2021. If the investors have got an allotment, the shares will be credited to the Demat account on 25th Nov2021. However, in case of non-allotment, the find will be refunded on 24th November2021.The shares of the Tarsons Limited will be listed on 26th November2021 on NSE and BSE as well.

The firm will not receive any proceeding from the offer for sale. However , it will use the net proceeds from the fresh issue for repaying debt funding and capital expenditure for its new manufacturing facility at Panchla in West Bengal and some for general corporate purposes.

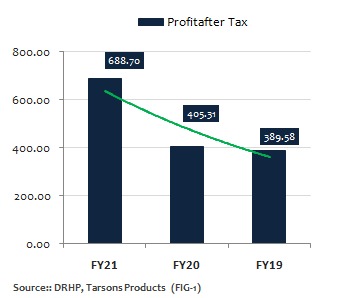

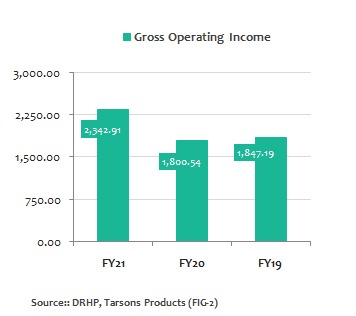

The firm has a good

history of profits and revenue, as depicted in Fig-1. In FY2021 saw a jump of 30% in revenue to Rs 2342.91 million. Operating

income in the last three years grew at a compounded annual growth rate of

8.24%, whereas PAT saw a CAGR of 20.9% in the last three years.

The firm doesn’t have any listed peers, thus it will be difficult to compare the performance of the firm. However looking at the financial, the IPO seems to be a valuable investment, However, it is very important to understand that every investment in the share markets is subjected to market risk and investors must do their thorough research, before investing.