Let’s know NSE IFSC

NSE IFSC Limited is a fully owned subsidiary company of National Stock Exchange of India Limited (NSE), incorporated on November 29, 2016, by the Registrar of Companies, Gujarat. The organization has received approval from SEBI to establish an international exchange in Gujarat International Finance Tech City (GIFT) – International Financial Service Centre (IFSC) Gandhinagar. Stock exchanges operating in the GIFT IFSC are permitted to offer trading in securities in any currency other than the Indian rupee.

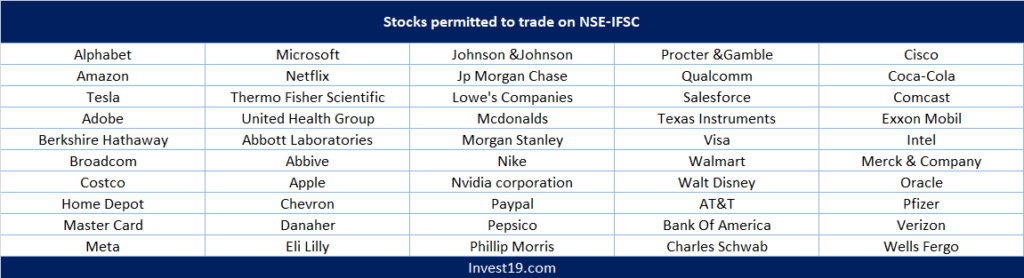

US stocks to trade on NSE IFSC

NSE IFSC has received permission to trade receipt of 50 US stocks. However, as of now only, 8 will be listed namely,

- Amazon

- Tesla

- Alphabet

- Meta Platforms

- Microsoft

- Netflix

- Apple

- Walmart.

NSE IFSC Receipt

It is a negotiable financial instrument of unsponsored depository receipts. It is a derivative product, so investors can invest directly without going through any registered broker.

Investors will be provided with an option to trade in fractional quantity in comparison to the underlying security trading in the US. This will make US stock affordable for investors.

It is similar to buying stocks domestically, but you buy shares of the foreign company a get an issued receipt against them known as NSE IFSC receipt.

How does the fraction of a shared work?

Buying one recipient of stock, wouldn’t mean that you own one share of the foreign entity. NSE IFSC receipt holder will have a proportionate benefit of the underlying shares depending on the ratio. This ratio is expressed like 1:N. Let’s say for apple the ratio is 1:25, which means 25 NSE IFSC receipts is equivalent to one share of Apple. So to own one share of Apple Inc. , the investor has to buy 25 NSE IFSC receipts from Apple.

Steps for Indian Resident to trade in NSE IFSC

- Register with an IFSCA registered Trading member

- Complete “Know Your Client” requirements.

- Complete documentation for Liberalized Remittance Scheme(LRS) with the bank.

- Transfer USD (US dollar) from bank to trading member’s bank Account in GIFT IBU

- Confirm that broker has given credit to your account.

- Start trading NSE IFSC receipt on NSE IFSC Platform.

Currency denomination for trading

This will be traded in US dollars with a minimum tick size of $0.01.

Trading hours

8:30 PM on day one to 2:30 PM on the next day is considered to be one trading day.

Trading types

Intra-day trading for Indian retail investors is allowed

- till it’s not exceeding the overall LRS limit of $250,000 per year.

- Each transaction is backed by adequate transaction value

Short Selling is allowed:

- Sell transactions should be either backed by NSE IFSC Receipt or should sell against an open buy position created during the day.

Settlement Cycle

All NSE IFSC receipts will be settled by NSE IFSC Clearing Corporation Limited (NICCL) on T+3 Days

Tax Liability

The receipts will be considered as foreign assets. Short-term gains will be taxed as per slab and long-term gains at 20% with indexation.

Potential Risk involved

- Price and Volatility risk

- Risk Of illiquidity

- Underlying Share risk( NSE IFSC Receipt is a derivative product)

- Risk of cancellation and termination of NSE IFSC receipt

- Tax risks

- Another market-related risks, such as a change in laws, settlement risk, trading risk, to name a few.