Nuvoco Vistas- a cement manufacturer with largest manufacturing capacity in East India is the 6th IPO in the month of August. A diversified portfolio of IPO has been witnessed this month in the form of QSR chain Devyani, online automotive platform Car Trade, CDMO player Windlas, ceramic producer Exxaro and Krsnaa Diagnostics. After a long span of time, a cement manufacturer is going for listing on the Indian bourses. The issue size of Nuvoco Vistas is a mix of fresh issue and offer for sale.

Nuvoco Vistas IPO Details

- Issuer Company: Nuvoco Vistas

- Industry: Cement

- IPO Size: 5,000 cr.

- Price Band: 560-570

- Issue Open Date: 09 Aug, 2021

- Issue Close Date: 11 Aug, 2021

- Listing Date: 23 Aug, 21

- Minimum Lot Size: 26 shares

- Face Value: 10 Rs. Per share

- Employee Discount:

- Retail Allocation: 35%

- Listing Exchange: NSE, BSE

Composition of Issue Size

The issue size of Rs. 5,000 cr. is a mix of fresh issue of Rs. 1,500 cr. and offer for sale of Rs. 3,500 cr. at the upper price band.

Offer for Sale: The object of the Offer for Sale is to allow Niyogi Enterprise to sell an aggregate of up to 61.4 million equity Shares held by them amounting at Rs. 3,500 cr. The company will not receive any proceeds from the Offer for Sale.

Fresh Issue: The company has planned to raise fresh capital comprising an aggregate of 2,63,15,789 equity shares having Face Value ₹10 aggregating up to Rs. 1,500 Cr at the upper price band of Rs. 570. Out of the net proceeds

- An amount of Rs. 1,350 cr. will be utilized for repayment/prepayment of certain borrowings taken by the company.

- Rest will be utilized for general corporate purpose.

About the Company

Nuvoco Vistas Corporation Limited manufactures cement and has an installed capacity of 14 MMTPA and is also one of the leading ready-mix concrete players in India. It has four integrated cement plants, two grinding units, one blending unit and a ready-mix concrete business. Its main brands are Concreto and Duraguard. After being launched in 2004, Concreto has been one of the best-selling brands for the company. Concreto and Duraguard are market leaders in terms of cement prices in the respective segment as well as regions. NVCL was initially a wholly owned subsidiary of Nirma, but in Fiscal 2020, Nirma has transferred its 100% holding in NVCL to Niyogi Enterprise Pvt Ltd (the promoter company). NVCL completed the acquisition of Emami’s cement business (8.3 MMTPA) at an enterprise value of INR 5,500 crore in July 2020, making it the largest player in East India with ~17% market share in terms of capacity on a consolidated level and the 5th largest player in India with a consolidated capacity of 22.32 MMTPA.

Must Read: Car Trade IPO will hit the primary market on Aug 09. Should you subscribe?

Industry Growth Drivers

- Growth of global cement production has remained muted over the past five years.

- India’s share in global cement manufacturing is on rise with a CAGR of 2.26%.

- India is the second largest cement consumer in the world behind China.

- Government’s push for the “Housing for All” scheme and ‘Affordable Housing’ will be the key drivers for rising demand.

- CRISIL Research expects cement demand to register a CAGR of 6 to 7% from Fiscal 2021 to Fiscal 2026.

- Gross budget of developing roads was 12.3% higher in FY2021 than the previous fiscal budget and expected to continue further.

Peers Comparison

The company will face tough competition from Ultratech Cement, Ambuja Cement, Shree Cement and ACC. Listed peers have been consistent compounders in a few years. Out of them Shree Cement promises highest EBITDA margins at 32%. Ultratech Cement has managed to gain market share by 111%. Shree Cement has highest Return on Net Worth at 14.82% and P/E ratio at 44.26x.

Financials

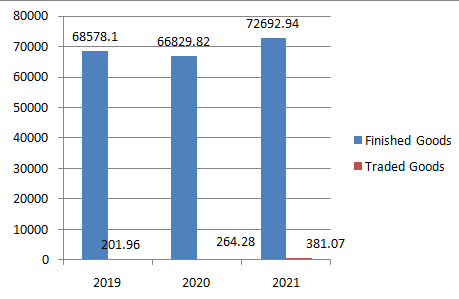

Sale of Products (Rs. in millions)

Observations

- Revenues of the company have risen marginally by 2.89% in last two years.

- Company generates majority of their income from selling finished goods (cement and ready-mix concrete) while traded goods (construction and chemicals) have nominal contribution.

- Revenues from finished goods have grown 8.77% in FY21.

Financial Statements

| Income Statement (In Millions) | FY21 | FY20 | FY19 |

| Gross Operating Income | 75226.93 | 68299.44 | 71058.88 |

| Cost of Employee & Inventory | 50745.64 | 46364 | 51831.44 |

| Other Expenses | 9537.75 | 8596.95 | 9513.09 |

| EBITDA | 14943.54 | 13338.49 | 9714.35 |

| Depreciation | 7937.87 | 5278.77 | 4979.00 |

| Interest | 6640.29 | 4192.21 | 4569.34 |

| Profit Before Tax | 365.38 | 3867.51 | 166.01 |

| Tax | 624.57 | 1374.96 | 430.89 |

| Profit After Tax | -259.19 | 2492.55 | -264.88 |

- Company’s revenue is marginally increased by 2.89% in last two years.

- EBITDA margins of the company stood at 19.86% in FY21, a muted response has been observed.

- Company has free cash flows at Rs. 50 cr. that can operate functions smoothly.

- Company’s borrowings have been increased substantially this year to Rs. 5,561.2 cr., an increase of 90% has recorded.

- Debt/Equity ratio of the company is currently 0.92x.

- Net proceeds from fresh issue will dilute borrowings further that will increase PAT margins and reduce Debt/Equity ratio.

- PAT is negative on account of high depreciation cost.

- Return on Capital Employed of the company is 4.21%.

Also Read: Devyani Int. has hit the market! It’s time to deep dive into its financials.