Another specialty chemical manufacturer is available for subscription in the primary market. Chemplast Sanmar- a leader in manufacturing specialty paste PVC (Poly Vinyl Chloride) resin that has application in building and construction, health care, electronics, automobiles, piping and siding, blood bags and tubing, wire and cable insulation etc. This is the 7th IPO in the month of August. The issue size of Chemplast Sanmar is a mix of fresh issue and offer for sale.

Chemplast Sanmar IPO Details

- Issuer Company: Chemplast Sanmar

- Industry: Specialty Chemicals

- IPO Size: 3,850 cr.

- Price Band: 530-541

- Issue Open Date: 10 Aug, 2021

- Issue Close Date: 12 Aug, 2021

- Listing Date: 24 Aug, 2021

- Minimum Lot Size: 27 shares

- Face Value: 5 Rs. Per share

- Employee Discount:

- Retail Allocation: 10%

- Listing Exchange: NSE, BSE

Composition of Issue Size

The issue size of Rs. 3,850 cr. is a mix of fresh issue of Rs. 1,300 cr. and offer for sale of Rs. 2,550 cr. at the upper price band.

Offer for Sale: The object of the Offer for Sale is to allow Sanmar Holdings Limited and others to sell an aggregate of up to 47.13 million equity Shares held by them amounting at Rs. 2,550 cr. The company will not receive any proceeds from the Offer for Sale.

Must Read: Car Trade IPO will hit the primary market on Aug 09. Should you subscribe?

Fresh Issue: The company has planned to raise fresh capital comprising an aggregate of 2,40,29,574 equity shares having Face Value ₹10 aggregating up to Rs. 1,300 Cr at the upper price band of Rs. 541. Out of the net proceeds

- An amount of Rs. 1,238.25 cr. will be utilized for early redemption of Non-Convertible Debentures issued by the Company.

- Rest will be utilized for general corporate purpose.

About the Company

Chemplast Sanmar Limited is a specialty chemicals manufacturer in India with focus on specialty paste PVC resin and custom manufacturing of starting materials and intermediates for pharmaceutical, agro-chemical and fine chemicals sectors. CSL is one of India’s leading manufacturers of specialty paste PVC resin on the basis of installed production capacity, as of December 31, 2020. In addition, the specialty player is also the third largest manufacturer of caustic soda and the largest manufacturer of hydrogen peroxide in the South India region, on the basis of installed production capacity as of December 31, 2020 and one of the oldest manufacturers in the chloromethanes market in India. Pursuant to the CCVL Acquisition, the company has acquired 100.0% equity interest in CCVL that is the second largest manufacturer of suspension PVC resin in India and the largest manufacturer in the South India region, on the basis of installed production capacity as of December 31, 2020. The product has high barriers to entry and limited competition is expected to benefit existing manufacturers of specialty paste PVC resin in India in the medium term and the demand for specialty paste PVC resin is expected to grow at a CAGR of 6% to 8% between FY 2022 and 2025.

Industry Growth Drivers

- China used to be the manufacturing hub but shift to India due to rising restrictions in China has opened various opportunities for Indian specialty chemicals.

- Average labor cost of China is growing at a CAGR of 19-20% while a 4-5% CAGR has been recorded in India. This accounts for higher operating margins in domestic companies.

- Many S-PVC plants have had to shut down or shift from mercury-based catalyst processes to mercury-free processes owing to strict environmental regulations in China.

- Chemplast Sanmar is a leading manufacturer of specialty paste PVC resin. Lack of raw material availability and technology creates barriers to enter specialty paste PVC resin market.

- Specialty paste PVC (Poly Vinyl Chloride) resin that has application in building and construction, health care, electronics, automobiles, piping and siding, blood bags and tubing, wire and cable insulation etc.

- Per capita consumption of specialty paste PVC resin in India is 0.1 kg compared with China’s 0.6 kg and Western Europe’s 2.4 kg. Thus, the Indian market is fairly underpenetrated.

Peers Comparison

The company will face tough competition from PI Industries, SRF Limited, Finolex Ltd. and Navin Fluorine Ltd. Out of the listed peers PI Industries, SRF and Navin Fluorine have delivered multi-bagger returns. Finolex Industries delivers highest Return on Net Worth at 23.50%. Navin Fluorine commands highest P/E ratio at 73.8x followed by PI Industries with 58.94x.

Financials

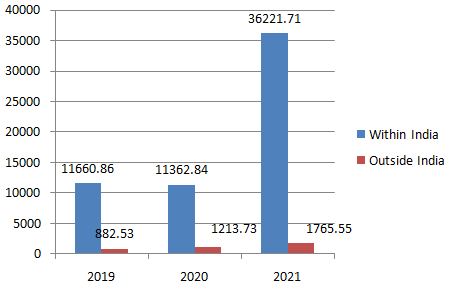

Sale of Products (Rs. in millions)

Observations

- Revenues of the company are increased substantially by 73.54% in last two years.

- Company generated 95% of their revenues domestically whiles rest are generated globally.

- Revenues from selling products in domestic area have been increased by 218% in FY21.

Financial Statements

| Income Statement (In Millions) | FY21 | FY20 | FY19 |

| Gross Operating Income | 38151.08 | 12655.1 | 12667.74 |

| Cost of Employee & Inventory | 22367.05 | 5041.82 | 4779.42 |

| Other Expenses | 6005.59 | 4411.54 | 4553.60 |

| EBITDA | 9778.44 | 3201.74 | 3334.72 |

| Depreciation | 1309.83 | 873.61 | 563.76 |

| Interest | 4333.62 | 954.57 | 482.75 |

| Profit Before Tax, Exceptional items and JV | 4134.99 | 1373.56 | 2288.21 |

| Share of restated profit/loss from joint ventures | 3315.91 | 656.54 | 354.22 |

| Profit on investments in Joint ventures | 4809.67 | ||

| Profit Before Tax and exceptional items | 5628.75 | 717.02 | 1933.99 |

| Exceptional Items | 156.84 | ||

| Profit before Tax | 5471.91 | 717.02 | 1933.99 |

| Tax | 1369.47 | 255.77 | 749.35 |

| Profit After Tax | 4102.44 | 461.25 | 1184.64 |

- Company’s revenue is increased substantially by 73.54% in last two years.

- EBITDA margins of the company stood at 25.6% in FY21.

- Company has sufficient cash flows at Rs. 303.48 cr. led by redemption of investments that may support them to operate smoothly.

- Company has increased its long-term borrowings heavily, currently stood at Rs. 2,024 cr.; however proceeds from fresh issue for payment of borrowing will reduce cost of debt that will increase PAT margins further.

- PAT grew by 195% in FY21.

- Considering the upper price band at Rs. 541 and FY21 Earning Per Share (EPS) of Rs. 30.6, the company is demanding a P/E multiple of 17.67x, much lower than the Industry P/E of 56.35x.

Also Read: Cement player Nuvoco Vistas will hit the primary market on Aug 09. Should you subscribe?