Rising demand of real estate for residential purpose after the pandemic of Covid-19 has pushed the demand of other sectors too. Aptus Value Housing Finance Ltd., 8th IPO in the month of August carries a promising story. What could be any better period of buying a home when cost of borrowing is lowest, stamp duty charges have been reduced and administration has released enough relief funds for the general public? The issue size of Aptus Value Housing Finance is a mix of fresh issue and offer for sale. Housing Finance company is looking to increase their Tier-1 capital requirements from net proceeds.

Aptus Value Housing Finance IPO Details

- Issuer Company: Aptus Value Housing Finance

- Industry: NBFC

- IPO Size: 2,780 cr.

- Price Band: 346-353

- Issue Open Date: 10 Aug, 2021

- Issue Close Date: 12 Aug, 2021

- Listing Date: 24 Aug, 2021

- Minimum Lot Size: 42 shares

- Face Value: 2 Rs. Per share

- Employee Discount:

- Retail Allocation: 35%

- Listing Exchange: NSE, BSE

Composition of Issue Size

The issue size of Rs. 2,780 cr. is a mix of fresh issue of Rs. 500 cr. and offer for sale of Rs. 2,280 cr. at the upper price band.

Offer for Sale: The object of the Offer for Sale is to allow Padma Anandan, Aravali Investment Holdings, Madison India Opportunities IV and others to sell an aggregate of up to 64.6 million equity Shares held by them amounting at Rs. 2,280 cr. The company will not receive any proceeds from the Offer for Sale.

Fresh Issue: The company has planned to raise fresh capital comprising an aggregate of 1,41,60,305 equity shares having Face Value ₹2 aggregating up to Rs. 500 Cr at the upper price band of Rs. 353. The net proceeds will be utilized for augmenting the Tier-I capital requirements of the Company.

Must Read: Car Trade IPO will hit the primary market on Aug 09. Should you subscribe?

About the Company

Aptus Value Housing Finance Limited is entirely retail focused housing finance company primarily serving low and middle income self-employed customers in the rural and semi-urban markets of India. According to the CRISIL Report, the Company had the highest Return on Assets of 5.7% among the peers during the FY21. Aptus Value Housing is one of the largest housing finance companies in south India in terms of AUM, as of March 31, 2021. The AUM of the company have increased from ₹22,472.33 million, as of March 31, 2019 to ₹40,677.62 million, as of March 31, 2021, at a CAGR of 34.54%.

The company has implemented a robust risk management architecture which is reflected in their asset quality. They conduct all aspects of lending operations in-house including sourcing, underwriting, valuation and legal assessment of collateral and collections, which enables them to maintain direct contact with their customers, reduces turn-around-times and the risk of fraud. Over years, the NBFC has studied and developed credit assessment models specific to over 60 types of customer profiles.

Industry Growth Drivers

- India is one of the fastest-growing major economies with second largest population.

- Per capita income is forecast to improve gradually with pick up in GDP growth and sustained low inflation. As per IMF estimates, India’s per capita income (at constant prices) is expected to grow at a CAGR of 6.7% from Fiscals 2020 to 2025.

- As per the RBI housing finance committee report, the average Indian household holds 77% of its total asset in real estate.

- Stamp duty reduction in Maharashtra. The decision was made to give some relief to consumers and boost sales of real estate that is expected to be followed by other states too.

- Home loan enquiries have increased post the first quarter of Fiscal 2021 on the back of pent up demand, reduced interest rates and attractive schemes provided by developers.

- Medium and small HFCs grew faster than overall HFCs, clocking 19.3% and 24.8% CAGR, respectively in FY21 and expected to grow further in coming years.

Peers Comparison

The company will face tough competition from Aavas Financiers Limited, Repco Home Finance, and Home First Finance in the listed space. Among the listed players, Aptus Value claims lowest Cost to Income ratio at 24.53% while the cost of borrowings of the company is on higher side at 10%. Leading HFC has largest branch network in South region and promises highest Return on Net Worth at 13.49% amongst peers.

Financials

Asset under Management (Rs. in millions)

Observations

- Total AUM has been increased at a CAGR of 34.54% in last two years.

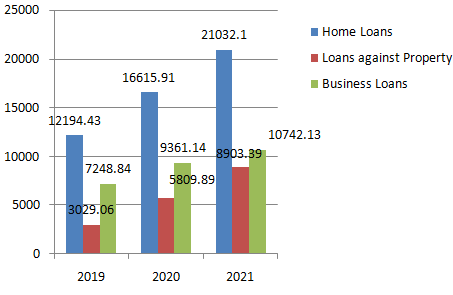

- Aptus Value generates 51.7% of their revenues from disbursing home loans while Loans against property and Business Loans generates 22% and 26% respectively.

- Revenues from Home Loans, Loans against property and Business Loans have increased by 26.5%, 53% and 14.75% respectively.

Financial Statements

| Income Statement (In Millions.) | FY21 | FY20 | FY19 |

| Interest Earned | 6,238.89 | 4,852.29 | 3,108.87 |

| Other Operating Income | 127.26 | 150.97 | 129.64 |

| Other Income | 186.27 | 233.94 | 132.64 |

| Total Income | 6,552.42 | 5,237.20 | 3,371.15 |

| Interest Expended | 2,065.34 | 1,845.49 | 1,162.18 |

| Net Interest Income | 4,300.81 | 3,157.77 | 2,076.33 |

| Operating expenses | 1,058.40 | 1,278.25 | 1,961.56 |

| Total Expenses | 3,101.51 | 2,764.30 | 1,844.09 |

| Profit before Taxes | 3,450.91 | 2,472.90 | 1,527.06 |

| Taxes | 781.47 | 362.78 | 412.23 |

| Net Profit for the Year | 2,669.44 | 2,110.12 | 1,114.83 |

- Company’s interest income is increased by 41.66% in last two years.

- Net Interest Income of the company stood at Rs. 4,300.81 million. Net Interest Margins have expanded from 9.90% to 10.10% in FY21.

- Company’s cost of borrowings has reduced from 10% to 9.13% but still at higher side among the listed peers.

- Employee cost to income is reduced from 12.9% to 11.21%, which shows rising operational efficiency of the company.

- Return on Net Worth of the company stands at 13.49%.

- Company has reported highest disbursement of loans growth in last 4 years at 33% among the peers.

- Asset under Management of the housing finance company is among the top five HFCs in India including Aadhar Housing Finance, Aavas Financiers, Repco Home Finance and Home First Finance as on FY21.

- Return on Assets at 5.73% is highest among the peers.

- Considering the upper price band at Rs. 120 and FY21 Earning Per Share (EPS) of Rs. 5.56, the company is demanding a P/E multiple of 63.48x, similar to its listed peers.

Also Read: Chemplast Sanmar has hit the primary market. Should you subscribe?