Automobile sector has been hit hard after the pandemic of Covid-19. Due to low purchasing power, general pubic was avoiding high expenditure purchases. As economy is getting back on track led by vaccination drive and global recovery people are buying automobiles again to cater their needs and to escape the use of public transport. Automobile sector is back now and in order to get benefit of listing gains, Rolex Rolled Rings has rolled out its IPO. The IPO of Rolex Rolled Rings is the 6th IPO in July after G R Infraprojects, Clean Science & Technology, Zomato, Tatva Chintan Pharma and Glenmark Life Sciences.

Rolex Rolled Rings Ltd. IPO Details

- Issuer Company: Rolex Rings.

- Industry: Auto Ancillaries

- IPO Size: 731 cr.

- Price Band: 880-900

- Issue Open Date: 28 July, 21

- Issue Close Date: 30 July, 21

- Listing Date: 09 Aug, 21

- Minimum Lot Size: 16 shares

- Face Value: 10 Rs. Per share

- Employee Discount: NA

- Retail Allocation: 35%

- Listing Exchange: NSE, BSE

Composition of Issue Size

The issue size of 731 cr. is a mix of fresh issue of Rs. 56 cr. and offer for sale of Rs. 675 cr. at the upper price band.

Must Read: Glenmark Life Sciences will hit the primary market on July 27. Should you subscribe?

Offer for Sale: The object of the Offer for Sale is to allow PE investor Rivendell LLC to sell an aggregate of up to 7.5 million equity Shares held by them amounting at Rs. 675 cr. The company will not receive any proceeds from the Offer for Sale.

Fresh Issue: The company has planned to raise fresh capital comprising an aggregate of 6,22,222 equity shares having Face Value ₹10 aggregating up to Rs. 56 Cr at the upper price band of Rs. 900. Out of the net proceeds

- An amount of Rs. 45 cr. will be utilized for funding long-term working capital requirements

- Rest will be utilized for general corporate purpose.

About the Company

Rolex Rings is one of the top five forging companies in India in terms of installed capacity, a manufacturer and global supplier of hot rolled forged and machined bearing rings. The company manufactures automotive components for all segments of vehicles including two-wheelers, passenger vehicles, commercial vehicles, off-highway vehicles, electric vehicles, industrial machinery, wind turbines and railways. The company supply domestically and internationally to large marquee customers including some of the leading bearing manufacturing companies, tier-I suppliers to global auto companies and some auto OEMs. Rolex Rings is one of the key manufacturers of bearing rings in India and caters to most of the leading bearing companies in India.

The company started its manufacturing operations in 1988 and its product portfolio includes a wide range of bearing rings, parts of gear box and automotive components, among others. The company supplies bearing rings and automotive components to over 60 customers in 17 countries, primarily located in India, United States of America and in European countries such as Germany, France, Italy, and Czech Republic, and Thailand. They have maintained long standing relations with customers and 70% of their 10 largest customers have been with them for over a decade.

Industry Growth Drivers

- India’s real GDP is projected to record an expansion of 10.1% in Fiscal 2022, led by the continued normalization in economic activities as the rollout of Covid-19 vaccines gather traction.

- Auto component Industry expected to grow at a CAGR of 10%-12% during Fiscal 2021- Fiscal 2025.

- Government of India has approved a financial outlay of Rs. 57,042 cr. over five years under Productivity Linked Incentives (PLI) Scheme for automobile and auto components industry.

- Indian bearing industry accounts for less than 4% of the global bearing market, though its share is expected to grow over the medium to long term, supported by increasing industrialization.

- Growing demand for railway equipment, electronics, aircraft and motorcycles in the developing countries like India will support growth for bearings and related products.

- ICRA expects that major automotive sub-segments to witness strong double digit growth in Fiscal 2022 that may push demand of gorge bearings.

Peers Comparison

The company will face tough competition from Bharat Forge, Ramkrishna Forgings and MM Forgings.

Direct competitors Ramkrishna and MM Forgings have been performers last year. Rising expenditure in industrial construction and other automotive sectors have increased the requirements of forgings. Bearing rings are critical to a lot of industrial machinery and auto components. The listed peers have gained 3-4 times from last year.

Financials

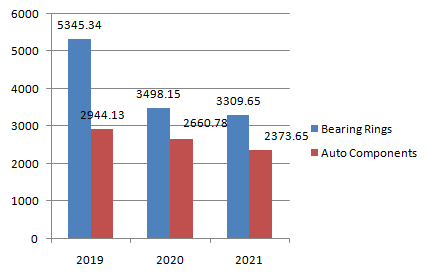

Sources of Revenue (Rs. in millions)

Observations

- Revenues of the company are falling continuously in last two years.

- As on FY21, company is generating 58% of their revenues from bearings rings while 42% of their revenues are generated from auto components.

- Revenues from ‘bearing rings’ have fallen 38% in last two years.

- While, revenues from ‘auto components’ have fallen 19.37% in last two years.

Financial Statements

| Income Statement (In Millions) | FY21 | FY20 | FY19 |

| Gross Operating Income | 6197.57 | 6753.32 | 9112.54 |

| Cost of Employee & Inventory | 3392.98 | 3819.92 | 4947.36 |

| Other Expenses | 1681.64 | 1625.64 | 2084.99 |

| EBITDA | 1122.95 | 1307.76 | 2080.19 |

| Depreciation | 254.09 | 265.24 | 254.40 |

| Interest | 116.99 | 321.69 | 420.19 |

| Profit Before Tax | 751.87 | 720.83 | 1405.60 |

| Tax | -117.7 | 191.42 | 815.19 |

| Profit After Tax | 869.57 | 529.41 | 590.41 |

- Company’s revenue has been decreased by 18.5% in last two years.

- EBITDA margins of the company stood at 18.11%.

- Company doesn’t have strong cash flows at Rs. 4.6 cr. and in order to operate smoothly it is raising funds to augment long-term working capital requirements.

- More than 50% of total cost is allocated to cost of raw materials and rising input prices of base metals could increase cost further..

- The firm is continuously reducing their long-term borrowings, which has further reduced their interest obligations heavily.

- PAT grew by 64.25% in FY21.

- Debt/Equity ratio of the company is 0.7x.

- Return on Equity or Net Worth is 24.38% while Return on Capital Employed is 19.63%

- Considering the upper price band at Rs. 900 and FY21 Earning Per Share (EPS) of Rs. 36.26, the company is demanding a P/E multiple of 24.8x, much lower than the Industry P/E of 134x.

Also Read: Zomato has a bumper listing! What investors should do now?