Pharmaceutical sector has been an outperformer in last year. Companies involved in activities associated with pharmaceutical industry such as API manufacturing, contract manufacturing, lab testing, medical instruments and selling of finished doses have outperformed the benchmark indices. IPOs are hot asset class now and a lot of companies have debut on bourses this year. In order to gain benefits of the bull market, Contract Development and Manufacturing Organization (CDMO) player Windlas Biotech is going to debut in the Indian market. The IPO will be available for subscription from Aug 04.

Windlas Biotech Ltd. IPO Details

- Issuer Company: Windlas Biotech.

- Industry: Pharmaceuticals

- IPO Size: 401.54 cr.

- Price Band: 448-460

- Issue Open Date: 04 Aug, 21

- Issue Close Date: 06 Aug, 21

- Listing Date: 17 Aug, 21

- Minimum Lot Size: 30 shares

- Face Value: 5 Rs. Per share

- Employee Discount: NA

- Retail Allocation: 35%

- Listing Exchange: NSE, BSE

Composition of Issue Size

The issue size of Rs. 401.54 cr. is a mix of fresh issue of Rs. 165 cr. and offer for sale of Rs. 236.54 cr. at the upper price band.

Offer for Sale: The object of the Offer for Sale is to allow Vimla Windlass and Tao India PE Fund II to sell an aggregate of up to 5.14 million equity Shares held by them amounting at Rs. 236.54 cr. The company will not receive any proceeds from the Offer for Sale.

Must Read: Tatva Chintan IPO has doubled the investor’s wealth. What investors should do now?

Fresh Issue: The company has planned to raise fresh capital comprising an aggregate of 35,86,956 equity shares having Face Value ₹5 aggregating up to Rs. 165 Cr at the upper price band of Rs. 460. Out of the net proceeds

- An amount of Rs. 50 cr. will be utilized for capacity expansion of existing facility at Dehradun plant.

- Rs. 47.56 cr. will be allocated for funding incremental working capital requirements.

- An amount of Rs. 20 cr. will repay/prepay certain borrowings.

- Rest will be utilized for general corporate purpose.

About the Company

Windlas Biotech is amongst the top five players in the domestic pharmaceutical formulations contract development and manufacturing organization industry in India in terms of revenue. With over two decades of experience in manufacturing both solid and liquid pharmaceutical dosage forms and significant experience in providing specialized capabilities, including, high potency, controlled substances and low solubility. The company provides a comprehensive range of CDMO services ranging from product discovery, product development, licensing and commercial manufacturing of generic products, including complex generics, in compliance with current Good Manufacturing Practices with a focus on improved safety, efficacy and cost.

The company is managed by professional and experienced Promoters and a senior management team with significant expertise in the pharmaceutical industry. Promoter and Whole-time Director Ashok Kumar Windlass has over 20 years of experience in the manufacturing and pharmaceutical business in India, while Hitesh Windlass, Promoter and Managing Director, help in regards to the strategic, corporate and technical operations. The firm leverages the experience of their Individual Promoters and senior management team to anticipate and address market trends, manage and grow our operations, maintain and leverage customer relationships and respond to changes in customer preferences.

Industry Growth Drivers

- Global pharmaceutical market to grow at approximately 5% CAGR over the next five years.

- Global formulations outsourcing market to grow at approximately 8.5% CAGR over the next five years.

- Government of India has approved a financial outlay of Rs. 6,900 cr. over five years under Productivity Linked Incentives (PLI) Scheme to push domestic manufacturing of some identified APIs (Active Pharmaceutical Ingredients).

- Government of India has approved a financial outlay of Rs. 3,000 cr. over five years under creation of bulk drug park scheme to support drug manufacturing units.

- Many pharmaceutical companies have identified the benefits of outsourcing to a contract manufacturing company due to growing demand for generic medicines and biologics, capital-intensive nature of the business and complex manufacturing requirements.

Peers Comparison

The company has no listed peer s in India that is engaged in similar business while some unlisted peers are: Akums Drugs, Synokem Pharmaceuticals, Theon pharmaceuticals, Innova Captab and Tirupati Medicare.

Financials

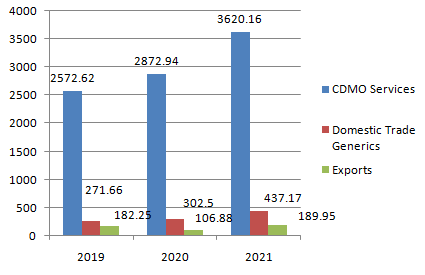

Sources of Revenue (Rs. in millions)

Observations

- 84% of their revenues are generated from CDMO services while Domestic Trade Generics and Exports generate 8.84% and 5.93% of total revenues respectively.

- Windlas has managed to increase their revenues by 17.58% in last two years

- Revenues from CDMO services have increased by 18% while other sources of revenue have marginal impact on total revenues.

Financial Statements

| Income Statement (In Millions) | FY21 | FY20 | FY19 |

| Gross Operating Income | 4306.95 | 3313.39 | 3115.25 |

| Cost of Employee & Inventory | 3327.29 | 2551.7 | 2348.81 |

| Other Expenses | 401.81 | 322.16 | 338.78 |

| EBITDA | 577.85 | 439.53 | 427.66 |

| Depreciation | 129.65 | 92.93 | 105.91 |

| Interest | 12.9 | 25.26 | 48.38 |

| Share in gain/loss from joint ventures | -1.73 | -74.66 | -7.67 |

| Exceptional Items | -216.17 | 495.45 | |

| Profit Before Tax | 217.4 | 246.68 | 761.15 |

| Tax | 61.7 | 84.55 | 122.93 |

| Profit After Tax | 155.7 | 162.13 | 638.22 |

- Company’s revenue has been increased by 17.58% in last two years.

- EBITDA margins of the company stood at 13.4%.

- Company has strong cash flows of Rs. 16 cr. and in order to smooth out its operations further, it is raising funds to augment long-term working capital requirements.

- More than 70% of total cost is allocated to cost of raw materials and rising input prices of base metals could increase cost further..

- The firm is continuously reducing their long-term borrowings and has become debt-free now.

- PAT has fallen by 3.9% in FY21 on account of one-time Exceptional cost.

- Return on Capital Employed is at 14.4%, not impressive in comparison with unlisted peers.

- As per the upper price band at Rs. 460 and FY21 Earning Per Share (EPS) of Rs. 8.7, the company is demanding a P/E multiple of 53x, which has been increased due to one- time expenditure in exceptional items.

Also Read: Paytm and Mobikiwk filed their DRHP to market regulator SEBI