The management of Exxaro Tiles has chosen August 04 to open its IPO for subscription. Alongwith Exxaro Tiles; Devyani Int., Windlas Biotech and Krsnaa Diagnostics are going to open on same day. The month of August has started with a lot of IPOs and firms are going to garner Rs. 3,614 cr. from the market. The issue size is a mix of fresh issue and offer for sale. Exxaro Tiles is the leading manufacturer of vitrified tiles in different sizes. The company has PAN India presence in 27 states of India. The firm has 6 display centers in 6 cities and 2 marketing offices in Delhi and Morbi.

Exxaro Tiles Ltd. IPO Details

- Issuer Company: Exxaro Tiles.

- Industry: Ceramics

- IPO Size: 161.09 cr.

- Price Band: 118-120

- Issue Open Date: 04 Aug, 2021

- Issue Close Date: 06 Aug, 2021

- Listing Date: 17 Aug, 21

- Minimum Lot Size: 125 shares

- Face Value: 10 Rs. Per share

- Employee Discount: NA

- Retail Allocation: 35%

- Listing Exchange: NSE, BSE

Composition of Issue Size

The issue size of Rs. 161.09 cr. is a mix of fresh issue of Rs. 134.23 cr. and offer for sale of Rs. 26.86 cr. at the upper price band.

Offer for Sale: The object of the Offer for Sale is to allow Mr. Dixit Kumar Patel to sell an aggregate of up to 2.23 million equity Shares held by them amounting at Rs. 26.86 cr. The company will not receive any proceeds from the Offer for Sale.

Must Read: Windlas Biotech IPO will hit the primary market on Aug 04. Should you subscribe?

Fresh Issue: The company has planned to raise fresh capital comprising an aggregate of 1,11,86,000 equity shares having Face Value ₹10 aggregating up to Rs. 134.23 Cr at the upper price band of Rs. 120. Out of the net proceeds

- An amount of Rs. 50 cr. will be utilized for repayment/prepayment of certain borrowings.

- An amount of Rs. 45 cr. will be utilized for funding working capital requirements.

- Rest will be utilized for general corporate purpose.

About the Company

Exxaro Tiles is engaged in manufacturing and marketing of vitrified tiles used majorly for flooring solutions. The company has commenced its operations in 2008 as a manufacturer of fit which is one of the raw materials used in manufacturing of titles. Later on, it diversified and expanded its operations in the manufacturing of vitrified tiles. Their business operations are divided into two product categories. 1) Double Charged Vitrified Tiles: These tiles are fed through a press which prints the pattern with a double layer of pigment, 3-4 mm thicker than other type of tiles. This process does not permit complex patterns but results in a long wearing tile surface, suitable for heavy traffic commercial projects. 2) Glazed Vitrified Tiles: These are flat slabs manufactured from ceramic materials such as clay, feldspar and quartz and other additives and fired at high temperatures to ensure high strength and low water absorption. These tiles are coated with glaze materials prior to the firing process.

The product basket of the company has 1000+ designs which are marketed under the brand ‘Exxaro’. The brand series of the company include: Topaz Series, Galaxy Series and High Gloss Series. The company has PAN India presence and supply in over 12 countries.

Industry Growth Drivers

- Rising disposable income from Indian households possess enough opportunities for the ceramic industry to grow.

- Government schemes on housing and infrastructure will boost the demand of ceramics in the upcoming years.

- Indian government is on the road of revival and ceramics industry is expected to grow further.

- Indian ceramics industry expected to grow at a healthy rate of around 12%-14% in next two years.

- Exports from India has doubled in last three years and expected to deliver similar growth further.

- Real estate slowdown is over and NBFCs are flooded with funds. This may boost the sales of tiles industry.

- Government had imposed anti-dumping duty on China to restrict imports of cheap tiles from China for five years in July 2017.

- Falling interest rates, stamp duty charges and fiscal stimulus from government will push the realty sector which may further advance the demand of tiles industry.

Peers Comparison

The company has a wide list of listed peer s such as Kajaria Ceramics, Asian Granito, Somany Ceramics, Orient Bell and Murudeshwar Ceramics. Among the listed peers, Kajaria Ceramics has highest Return on Net Worth at 11.88%. Orient Bell has the highest P/E ratio at 61.2x.

Financials

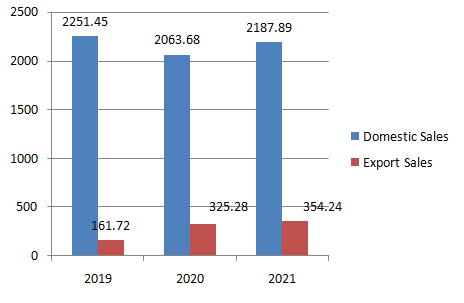

Sale of Products geographically (Rs. in millions)

Observations

- Revenues of the company have risen marginally by 3.19% in last two years.

- As on FY21, company is generating 86% of their revenues from selling products domestically.

- Revenues from domestic sales have grown 6% in FY21.

- While, revenues from exports have increased by 8.7% in last two years.

Financial Statements

| Income Statement (In Millions) | FY21 | FY20 | FY19 |

| Gross Operating Income | 2598.53 | 2439.64 | 2440.06 |

| Cost of Employee & Inventory | 1036.63 | 978.28 | 1241.98 |

| Other Expenses | 1041.36 | 999.53 | 802.24 |

| EBITDA | 520.54 | 461.83 | 395.84 |

| Depreciation | 136.34 | 142.97 | 140.81 |

| Interest | 212.6 | 197.18 | 178.28 |

| Profit Before Tax | 171.6 | 121.68 | 76.75 |

| Tax | 19.37 | 9.09 | -12.42 |

| Profit After Tax | 152.23 | 112.59 | 89.17 |

- Company’s revenue is marginally increased by 3.19% in last two years.

- EBITDA margins of the company stood at 20.03% in FY21 increased from 19% in FY20.

- Company has very less cash flows at Rs. 2.18 cr. however; the net proceeds of Rs. 45 cr. from fresh issue to augment working capital requirements will help in operating functions smoothly.

- The firm has reduced their long-term borrowings by Rs. 14 cr. last year and proceeds from fresh issue for payment of borrowing will reduce cost of debt that will increase PAT margins further.

- PAT grew by 35% in FY21.

- Debt/Equity ratio of the company is 0.5x.

- Return on Equity or Net Worth is 11.88% while Kajaria Ceramics claims highest RONW at 16.48% among listed peers.

- Considering the upper price band at Rs. 120 and FY21 Earning Per Share (EPS) of Rs. 4.54, the company is demanding a P/E multiple of 28.30x, much lower than the Industry P/E of 48.75x.

Also Read: Tatva Chintan IPO has doubled the investor’s wealth. What investors should do now?