It says that “Things never grow in isolation”. The rise of a sector in equity markets also brings sunshine in the associated sectors too. As quick as the OTT (Over the Top) media platforms are gearing up in the Indian media sector and spending budget of Indian families is rising on weekend parties, the restaurant chains are gaining the limelight. After the success stories of Jubilant Foodworks and Westlife Development, Burger King and Barbeque Nation in the Indian secondary market, Devyani International is set to open on August 04 with fresh issue and Offer for Sale. The company operates KFC, Pizza Hut and Costa Coffee as their core brands in India.

Devyani International Ltd. IPO Details

- Issuer Company: Devyani Int.

- Industry: Food chain

- IPO Size: 1,838 cr.

- Price Band: 86-90

- Issue Open Date: 04 Aug, 2021

- Issue Close Date: 06 Aug, 2021

- Listing Date: 16 Aug, 2021

- Minimum Lot Size: 165

- Face Value: 1

- Employee Discount:

- Retail Allocation: 10%

- Listing Exchange: NSE, BSE

Composition of Issue Size

The issue size of Rs. 1,838 cr. is a mix of fresh issue of Rs. 440 cr. and offer for sale of Rs. 1,398 cr. at the upper price band.

Offer for Sale: The object of the Offer for Sale is to allow Dunearn Investment Pte. Ltd. and RJ Corp. to sell an aggregate of up to 15.5 cr. equity Shares held by them amounting at Rs. 1,398 cr. The company will not receive any proceeds from the Offer for Sale.

Fresh Issue: The company has planned to raise fresh capital comprising an aggregate of 48.8 million equity shares having Face Value ₹1 aggregating up to Rs. 440 Cr at the upper price band of Rs. 90. Out of the net proceeds

- An amount of Rs. 324 cr. will be utilized for repayment/prepayment of certain borrowings.

- Rest will be utilized for general corporate purpose.

About the Company

Devyani International is the largest franchisee of Yum Brands in India and is among the largest operators of chain quick service restaurants (QSR) in India and operates 655 stores across 155 cities in India, as of March 31, 2021. Yum! Brands Inc. operates brands such as KFC, Pizza Hut and Taco Bell brands and has presence globally with more than 50,000 restaurants in over 150 countries, as of December 31, 20201. In addition, we are a franchisee for the Costa Coffee brand and stores in India. Their business is broadly classified into three verticals that includes stores of KFC, Pizza Hut and Costa Coffee operated in India (KFC, Pizza Hut and Costa Coffee referred to as “Core Brands”, and such business in India referred to as the “Core Brands Business”) stores operated outside India primarily comprising KFC and Pizza Hut stores operated in Nepal and Nigeria (“International Business”) and certain other operations in the F&B industry, including stores of our own brands such as Vaango and Food Street (“Other Business”).

Must Read: Exxaro Tiles IPO will hit the primary market on Aug 04. Should you subscribe?

Industry Growth Drivers

- Urbanization in India is in rising trend and expected to continue in the upcoming years.

- Growth in the quick service restaurant (“QSR”) channel is supported by urbanization and increasing exposure of the youth to organized retail chain.

- The total foodservice revenue is expected to grow to ₹17,220.3 billion (US$219.4 billion) in 2025, registering a strong CAGR of 15.5% from 2020 to 2025.

- QSR channel is expected to lead the foodservice industry and likely to grow at a CAGR of 6.5% in next five years.

- The characteristics of the industry such as accounting transparency, continuous updating in their product offerings, less outlets penetration and organized operations with quality control will keep the sales of QSR chains intact.

- Indian families are getting more health conscious and organized food chain is an optimal fit for their dining.

- Rising trend of digital delivery platforms such as Zomato and Swiggy will increase the scope of QSRs.

- Devyani Int. is the single largest quick-service restaurant (QSR) company in India listed on Swiggy.

Peers Comparison

In the listed space, the organized food retail chain will face competition from Jubilant Foodworks, Burger King, Westlife Development and Barbeque Nation. While in the unlisted arena, the food retailer faces competition from all organized and unorganized food retail chains.

Financials

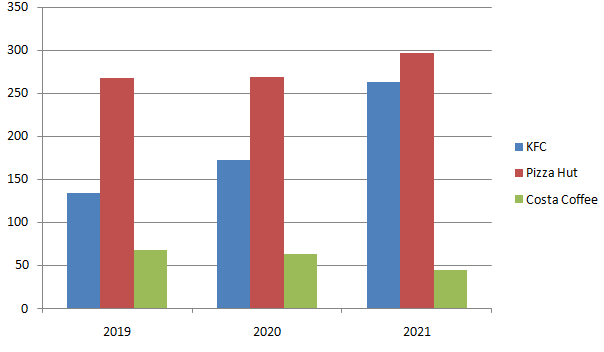

Growth in Core brand Outlets

Observations:

- Growth in KFC stores is outperforming other core brands. KFC stores have seen a growth rate of 40%

- Growth in Pizza Hut stores seems sluggish. The company has opened only 29 stores.

- Costa Coffee stores are closed heavily and company seems to focus mainly on KFC and Pizza Hut stores.

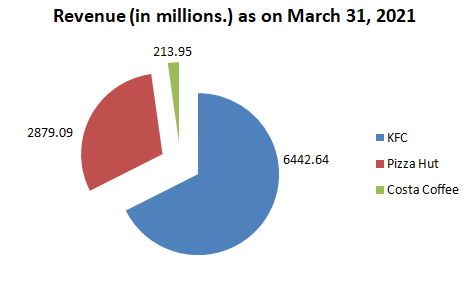

Break-down of revenue from core brands

- Company generates 81.5% or Rs. 9,776.06 million of their total revenues from the Core Brands- KFC, Pizza Hut and Costa Coffee.

- KFC generates 66% of the revenues from the Core brands.

- Same store sales growth has fallen sharply last year in KFC, Pizza hut and Costa Coffee by 33.69%, 30.25% and 61.64% respectively.

Financial Statements

| Income Statement (In Millions) | FY21 | FY20 | FY19 |

| Gross Operating Income | 11988.95 | 15350.41 | 13236.83 |

| Cost of Employee & Inventory | 4989.92 | 6858.81 | 5804.39 |

| Impairment of Non-Financial Assets | 480.05 | 38.77 | 247.53 |

| Other Expenses | 4089.18 | 5750.21 | 4511.97 |

| EBITDA | 2429.8 | 2702.62 | 2672.94 |

| Depreciation | 2294.53 | 2233.14 | 2028.26 |

| Interest | 1528.03 | 1584.37 | 1356.04 |

| Profit Before Tax | -1392.76 | -1114.89 | -711.36 |

| Exceptional Items | -568.84 | -345.78 | -131.48 |

| Tax | -10.68 | 18.41 | 13.02 |

| Profit After Tax | -813.24 | -787.52 | -592.9 |

- Revenues have been declined in FY21 by 22% due to reduced spending by people and restrictions on movement of man, material and machines this financial year.

- Majority cost of a food retail chain is allocated to cost of raw foods which has been slipped by 24.52%.

- Employee cost of the company has fallen by 31.5%.Cost of Employee & Inventory is slipped more in comparison with revenues which shows an operational efficiency is achieved by firm.

- EBITDA figure is fallen to Rs. 2,429.8 million reduced by 10%.

- Net Losses are expanded to Rs. 813.24 million from Rs.787.52 million.

- QSR chain has a free cash flows of Rs. 1,419.82 million

- Devyani Int. is a leveraged company as it has a debt of Rs. 359.38 cr.

Also Read: Windlas Biotech IPO will hit the primary market on Aug 04. Should you subscribe?