People cannot avoid getting diseased because their body is prone to get affected from virus and environmental change. Diagnostics sector which has strong cash flows and claims to have big industry size in coming years has gained a lot of traction these days. The industry is catered by a few private players and aggressively expanding their reach. Equity markets are also having a bull rally and in order to gain the listing benefits due to strong market and high potential sector, Krsnaa Diagnostics had filed its DRHP and it is opening on August 04. This is going to be the fourth IPO which has chosen August 04 to go live for application alongwith CDMO player Windlas Biotech, cermic manufacturer Exxaro Tiles, QSR operator Devyani International.

Krsnaa Ltd. IPO Details

- Issuer Company: Krsnaa Diagnostics.

- Industry: Healthcare

- IPO Size: 1,213.33 cr.

- Price Band: 933-954

- Issue Open Date: 04 Aug, 2021

- Issue Close Date: 06 Aug, 2021

- Listing Date: 17 Aug, 21

- Minimum Lot Size: 15 shares

- Face Value: 5 Rs. Per share

- Employee Discount: 93

- Retail Allocation: 10%

- Listing Exchange: NSE, BSE

Composition of Issue Size

The issue size of Rs. 1,213.33 cr. is a mix of fresh issue of Rs. 400 cr. and offer for sale of Rs. 813.33 cr. at the upper price band.

Offer for Sale: The object of the Offer for Sale is to allow Phi Capital, Kitara, Somerset and Lotus Management Solutions to sell an aggregate of up to 8.5 million equity Shares held by them amounting at Rs. 813.33 cr. The company will not receive any proceeds from the Offer for Sale.

Fresh Issue: The company has planned to raise fresh capital comprising an aggregate of 41,92,872 equity shares having Face Value ₹5 aggregating up to Rs. 400 Cr at the upper price band of Rs. 954. Out of the net proceeds

- An amount of Rs. 146 cr. will be utilized for repayment/prepayment of certain borrowings.

- An amount of Rs. 150.8 cr. will be allocated for establishing diagnostics centers at Punjab, Karnataka, Himachal Pradesh and Maharashtra.

- Rest will be utilized for general corporate purpose.

About the Company

Krsnaa Diagnostics is one of the largest differentiated diagnostic service providers in India. The diagnostics chain provides a range of technology-enabled diagnostic services such as imaging (including radiology), pathology/clinical laboratory and tele-radiology services to public and private hospitals, medical colleges and community health centres pan-India. The company operates one of India’s largest tele-radiology reporting hubs in Pune that is able to process large volumes of X-rays, CT scans and MRI scans round the clock and 365 days a year, and which allows them to serve patients in remote locations where diagnostic facilities are limited. The firm provides quality and inclusive diagnostic services at affordable rates across various segments. Since inception, we have served more than 23 million patients.

Must Read: KFC, Pizza Hut and Costa Coffee operator Devyani Int. IPO will hit the primary market on Aug 04.

Krsnaa Diagnostics has an extensive network of integrated diagnostic centres across India primarily in non-metro and lower tier cities and towns. As of June 30, 2021, the firm operated 1,823 diagnostic centres offering radiology and pathology services in 13 states across India. Their operating model involves diagnostic centres operated under a hospital-partnership model. These diagnostic centres are located within existing facilities of public and private hospitals or community health centres, and operated pursuant to arrangements with public health agencies and private healthcare providers.

Industry Growth Drivers

- Healthcare budget is increasing every year and FY22, especially, has seen a significant rise on account of the high expenses associated with tackling the COVID-19 pandemic.

- Between Fiscals 2011 and 2022, the budget for the Ministry of Health and Family Welfare clocked a CAGR of nearly 11% and expected to grow further.

- India’s current healthcare expenditure is skewed more towards private as against public expenditure.

- Public healthcare expenditure in India is aiming to grow steadily from 1% to 2.5% – 3% of the GDP.

- The Indian diagnostic industry has grown consistently over the past three fiscals and is projected to grow at a CAGR of approximately 15% between fiscals 2021 and 2023.

- Government-led (PPP model) diagnostic involves diagnostic players entering into a public-private-partnership agreement with the government to provide specific diagnostic services (pathology, radiology or both) for a specific concession period at predefined rates.

- The Government led PPP model is expected to grow continuously.

Peers Comparison

The company has a wide list of listed peers such as Dr. Lal Path Labs, SRL, Thyrocare, Vijaya, Suburban and Metropolis Healthcare. In comparison with the listed peers, Krsnaa Diagnostics has reported highest revenue growth on yoy basis. The firm also claims highest Return on Net Worth at 79.76%.

Financials

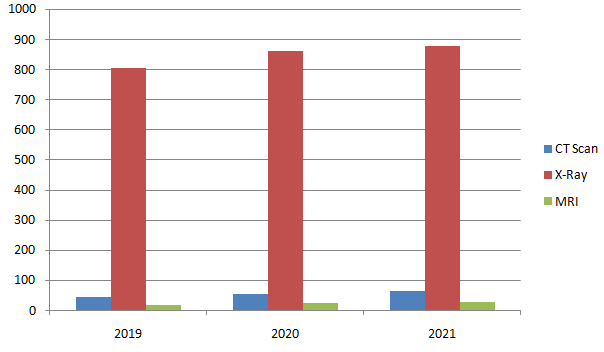

Number of Equipments purchased by Krsnaa Diagnostics

Observations:

- CT Scan equipments are increased by 18.7% in last 2 years.

- X-Ray machined have surged 4.38% in last 2 years. X-Ray equipments have witnessed slow additions.

- Heavy expenditure demanding MRI equipments are increased from 18 to 26 in last 2 years.

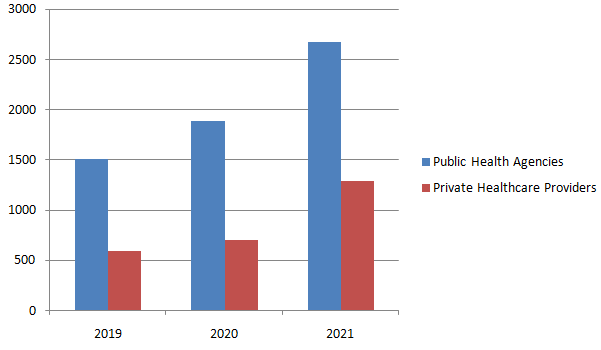

Break-down of revenue from direct operations

- Direct revenues of the company have increased strongly by 37.65% in last two years.

- Revenues from Public Health agencies have increased by 33.28% in last 2 years.

- While, from Private Healthcare providers revenues are surged by 48.38% on compounding basis in last two years.

Financial Statements

| Income Statement (In Millions) | FY21 | FY20 | FY19 |

| Gross Operating Income | 6614.76 | 2713.79 | 2143.15 |

| Cost of Employee & Inventory | 2215.35 | 3034.2 | 1934.83 |

| Other Expenses | 811.1 | 692.16 | 533.49 |

| EBITDA | 3588.31 | -1012.57 | -325.17 |

| Depreciation | 374.39 | 324.11 | 256.40 |

| Interest | 259.4 | 246.64 | 195.69 |

| Profit Before Tax | 2954.52 | -1583.32 | -777.26 |

| Tax | 1105.23 | -463.81 | -196.69 |

| Profit After Tax | 1849.29 | -1119.5 | -580.57 |

- Company’s direct revenues have increased strongly by 37.65% in last two years while total revenues were surged 144% in FY21 due to gain on fair value movement of Compulsory Convertible Preference Share.

- EBITDA margins of the company stood at 54% in FY21.

- Company has very less cash flows at Rs. 24.67 cr. which are sufficient for operating smoothly.

- The firm has long-term borrowings at Rs. 197 cr. and expected to reduce further from proceeds of fresh issue, which will increase PAT margins further.

- PAT is positive now and reached to Rs. 184.9 cr.

- Debt/Equity ratio of the company is 0.8x which will reduce substantially post-issue

- Considering the upper price band at Rs. 954 and FY21 Earning Per Share (EPS) of Rs. 12.25, the company is demanding a P/E multiple of 77.87x, much lower than the Industry P/E of 134.15x.

Also Read: Windlas Biotech IPO will hit the primary market on Aug 04. Should you subscribe?